The previous chapter presented adjustments that might be needed at the end of each accounting period. These adjustments were necessary to bring a company’s books and records current in anticipation of calculating and reporting income and financial position. This chapter begins by illustrating how such adjustments would be used to actually prepare financial statements.

The previous chapter presented adjustments that might be needed at the end of each accounting period. These adjustments were necessary to bring a company’s books and records current in anticipation of calculating and reporting income and financial position. This chapter begins by illustrating how such adjustments would be used to actually prepare financial statements.

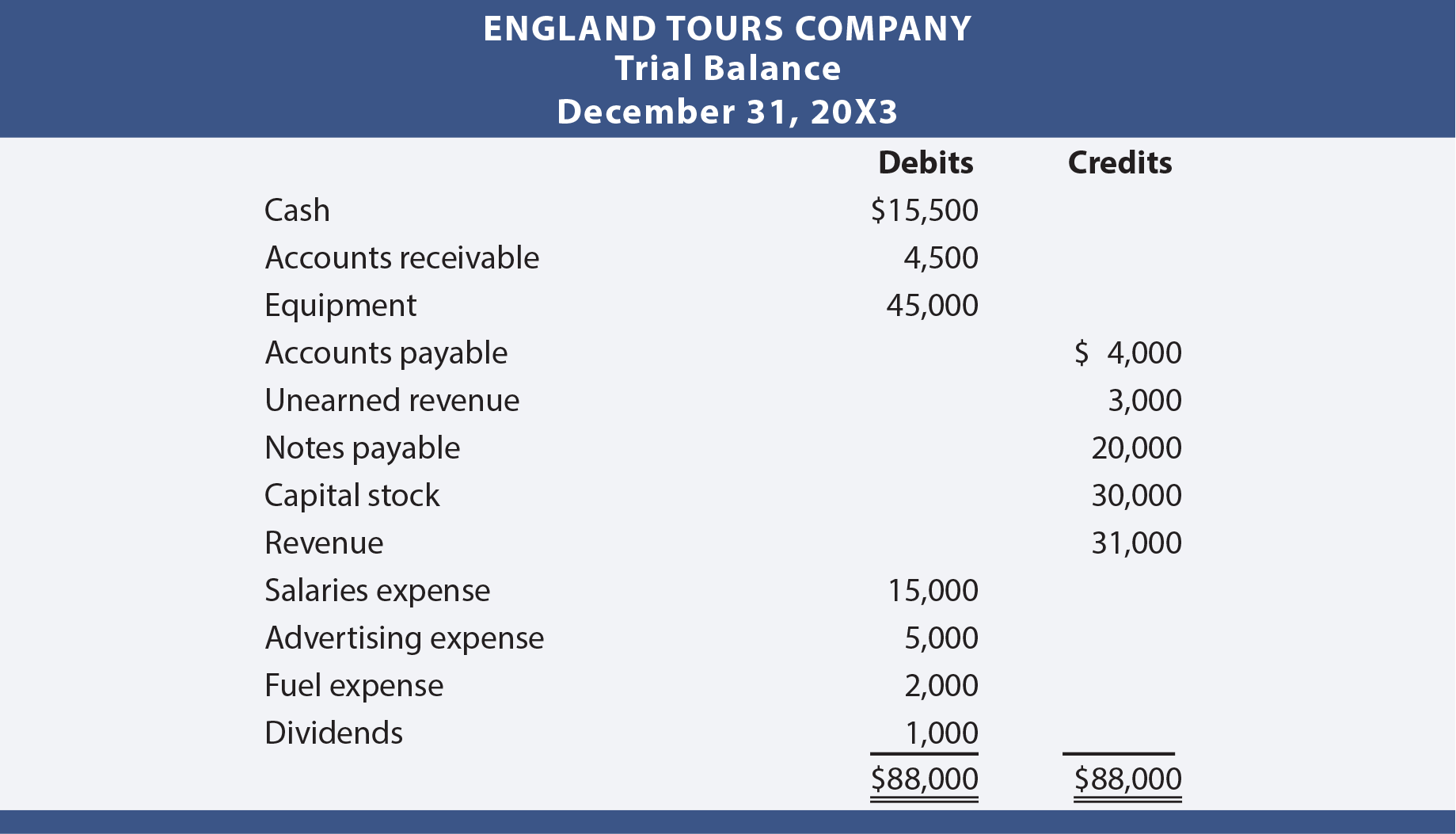

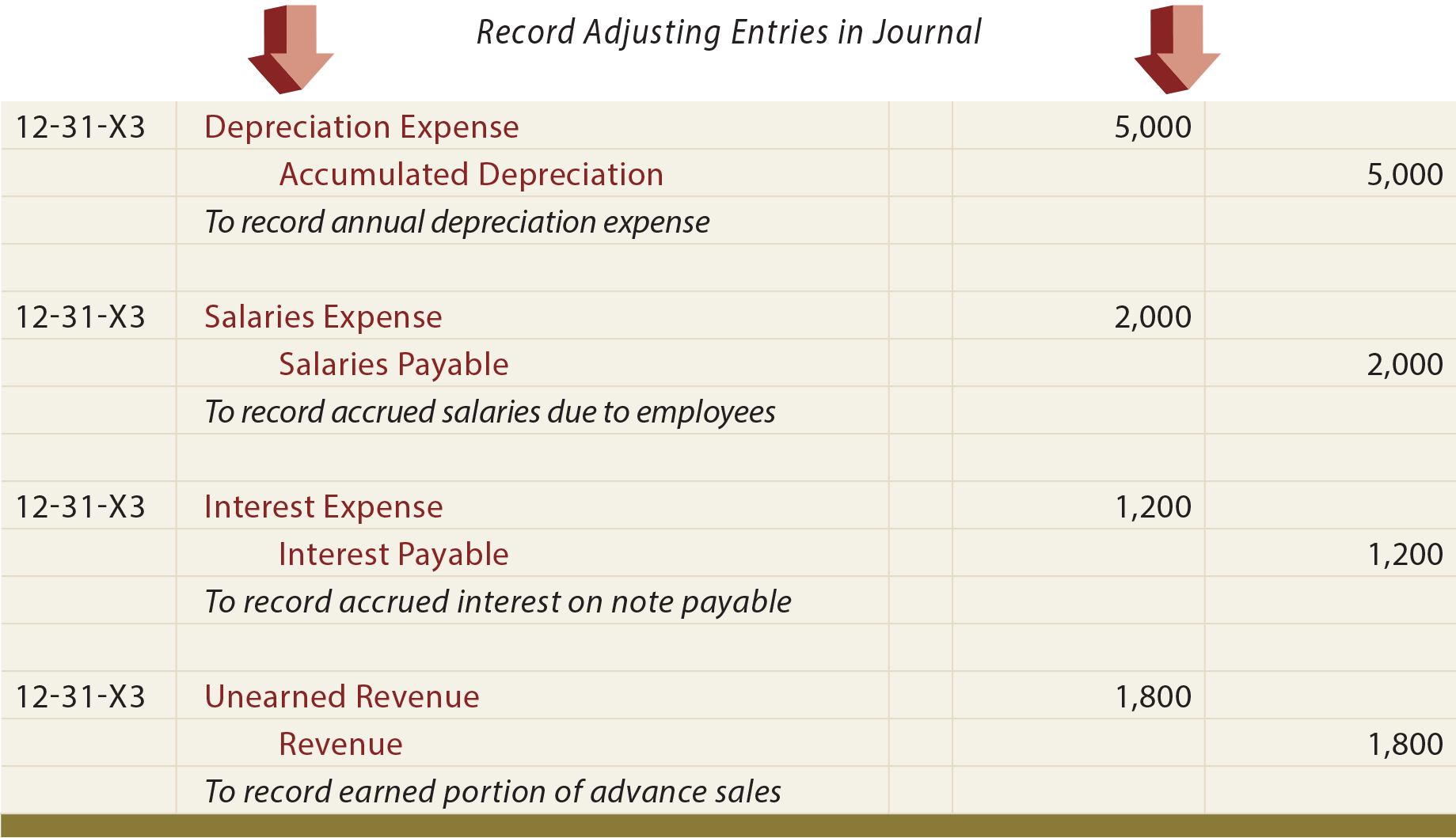

Assume that England Tours Company began operation early in 20X3. In the process of preparing its financial statements for the year ending December 31, 20X3, England determined that various adjusting entries were needed. These adjusting journal entries are shown on the following page. The numbers are all “assumed.” But, if it is unclear as to why any one of these entries might be needed, definitely review the detailed discussion in the previous chapter.

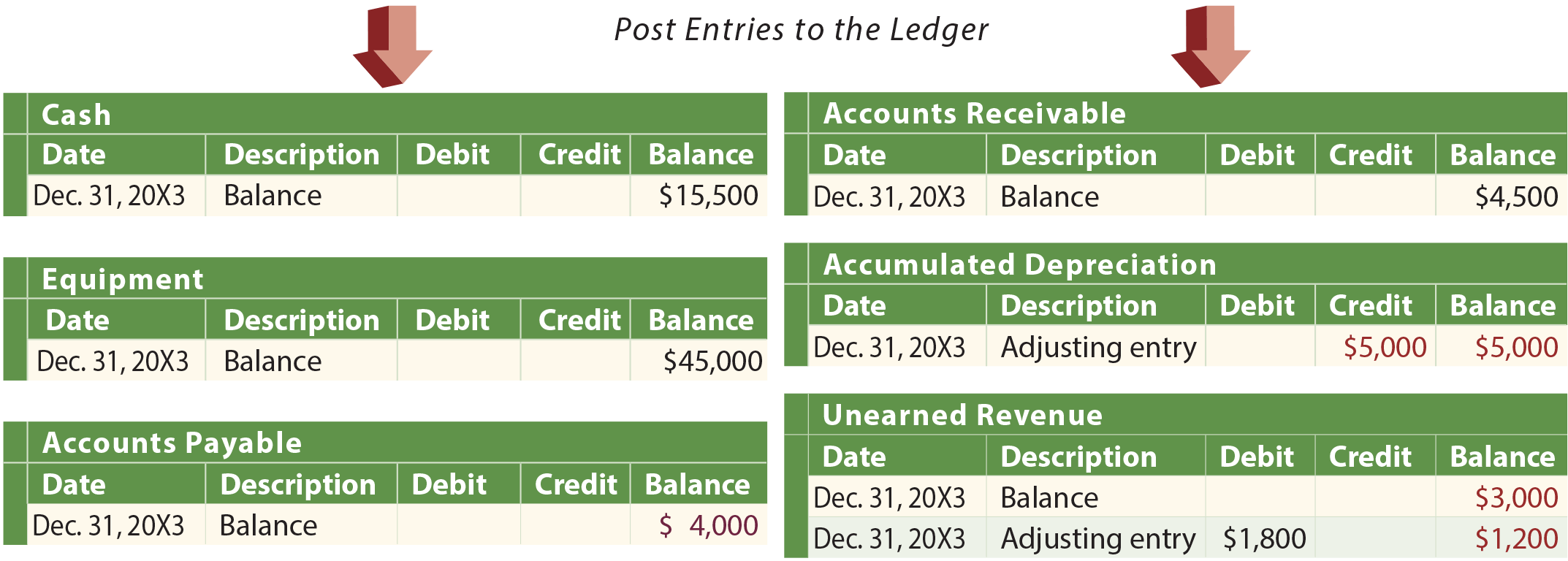

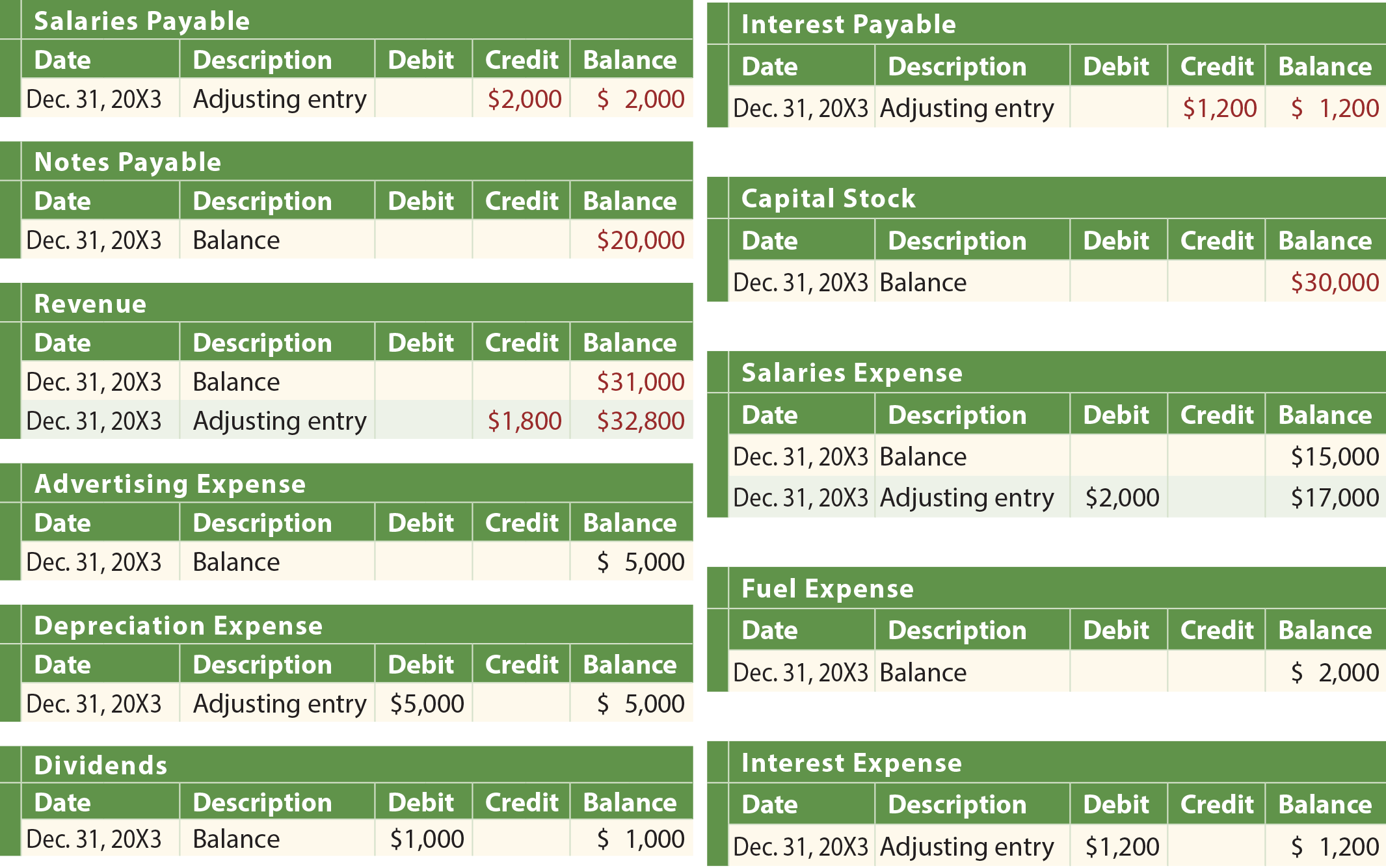

The illustration shows:

- England’s trial balance before the adjusting entries

- the adjusting journal entries

- the posting of the adjusting journal entries to the general ledger

- the adjusted trial balance.

If England attempts to prepare its financial statements based only on the unadjusted trial balance, the reported information would be incomplete and incorrect.

The Adjusting Process

Most of the time, a company will prepare its trial balance, analyze the trial balance for potential adjustments, and develop a list of necessary adjusting entries. Knowing what to adjust is not necessarily intuitive. It usually requires hands-on review by someone who is very knowledgeable about the business. As a practical matter, a company should not allow everyone to have access to the accounting system for purposes of entering year-end adjustments; too many errors and rogue entries will appear. Instead, a company will usually have a defined process where proposed entries are documented on a form (sometimes called a journal voucher). These forms are submitted to a chief accountant/controller for review and approval. The approved journal vouchers then serve as supporting documents to authorize data entry into the accounting system.

Financial Statements

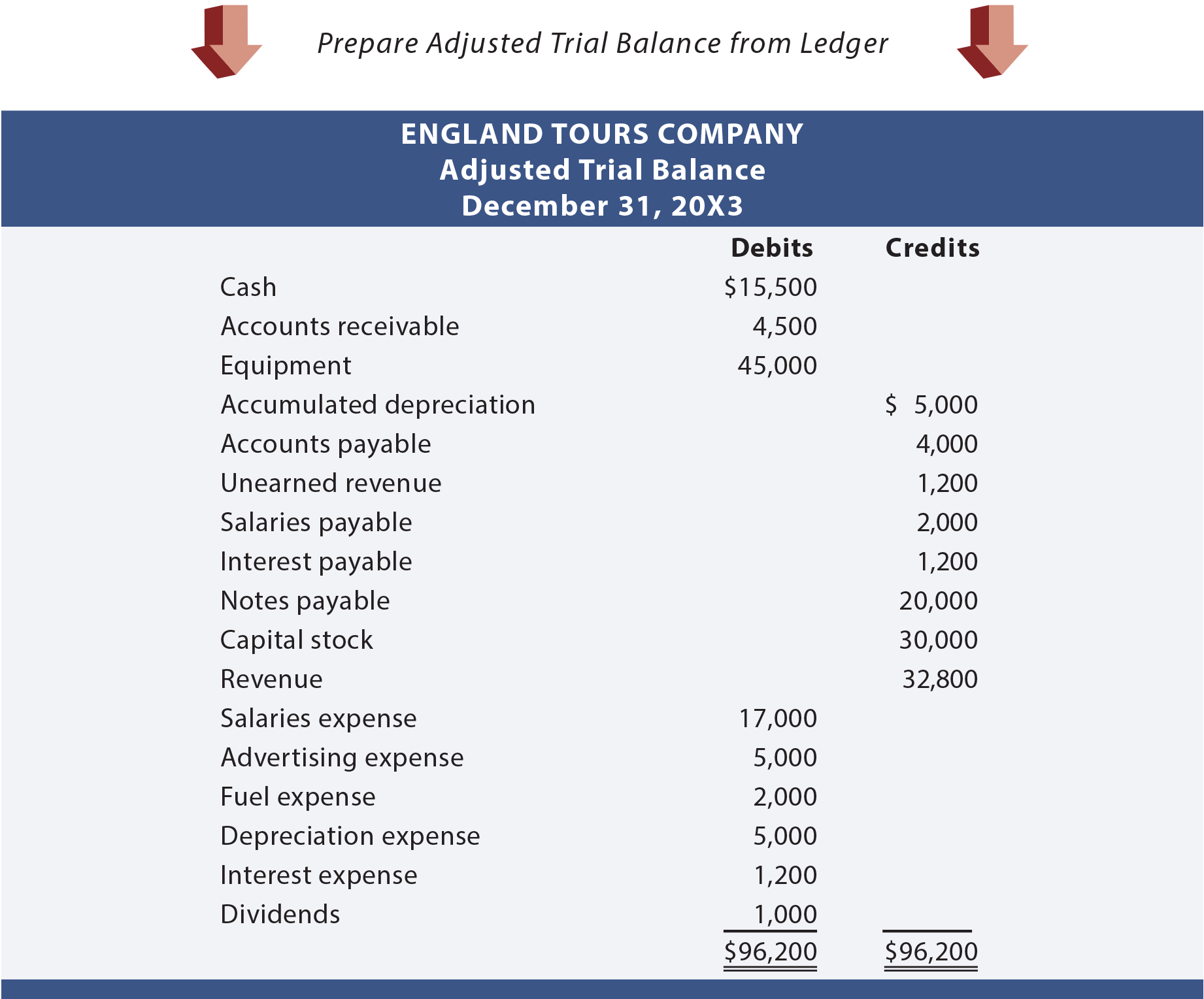

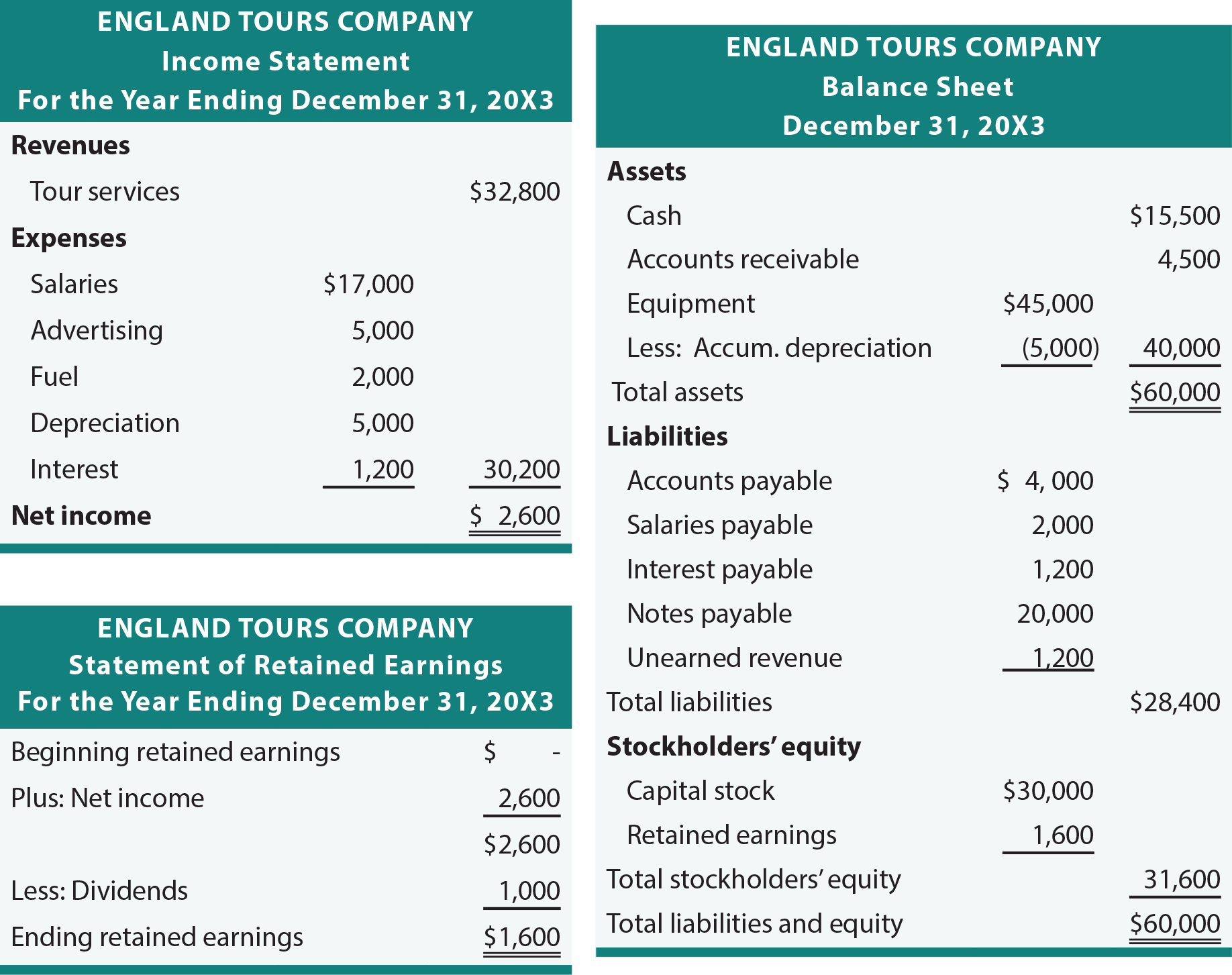

The adjusted trial balance is ordinarily sufficient to facilitate preparation of financial statements. Take time to trace the amounts from England’s adjusted trial balance to the following statements.

Accounting Software

The financial statement preparation process is mostly mechanical, and easily automated. Once the adjusting entries have been prepared and entered, every accounting software package will race through the steps of processing the data to produce the financial statements. As such, one might be inclined to discount the need to understand how to move amounts from an adjusted trial balance into a set of financial statements. In some respects that is true, just as it is true that one does not need to know how to add and subtract if they own a calculator. Of course, there is value in understanding addition and subtraction even with a calculator. In the same light, please consider that understanding the flow of transactions into financial statements is essential.

Worksheet Approach

Occasionally, one may desire to prepare financial statements that take into account necessary adjustments, but without actually updating journals and ledgers. Why? A manager may desire monthly financial reports even though the business may not formally prepare and book adjusting entries every month. A worksheet approach can be used for this purpose. Or, an auditor may use a worksheet to prepare financial statements that take into account recommended adjustments, before proposing that the actual journal/ledger be updated.

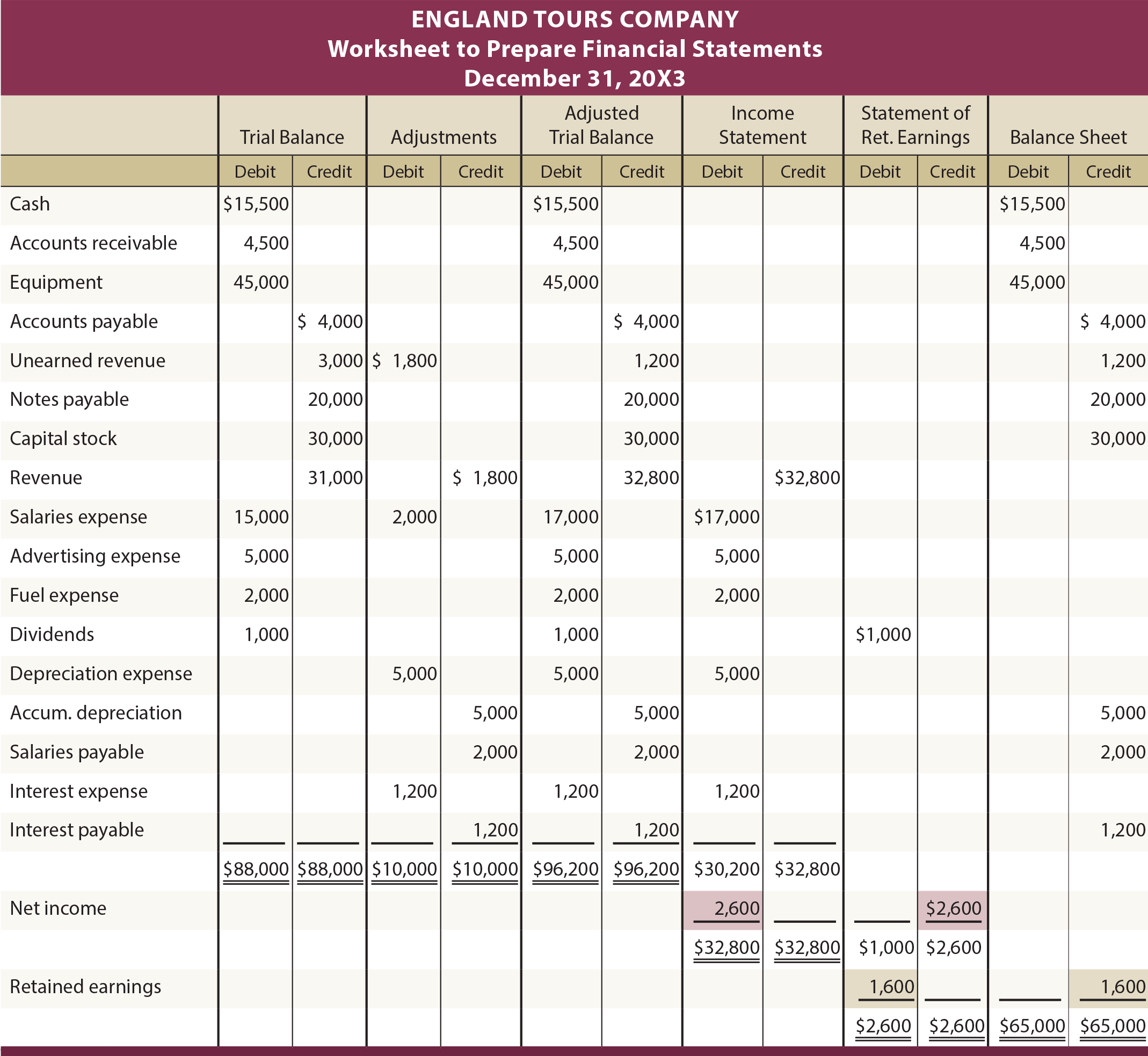

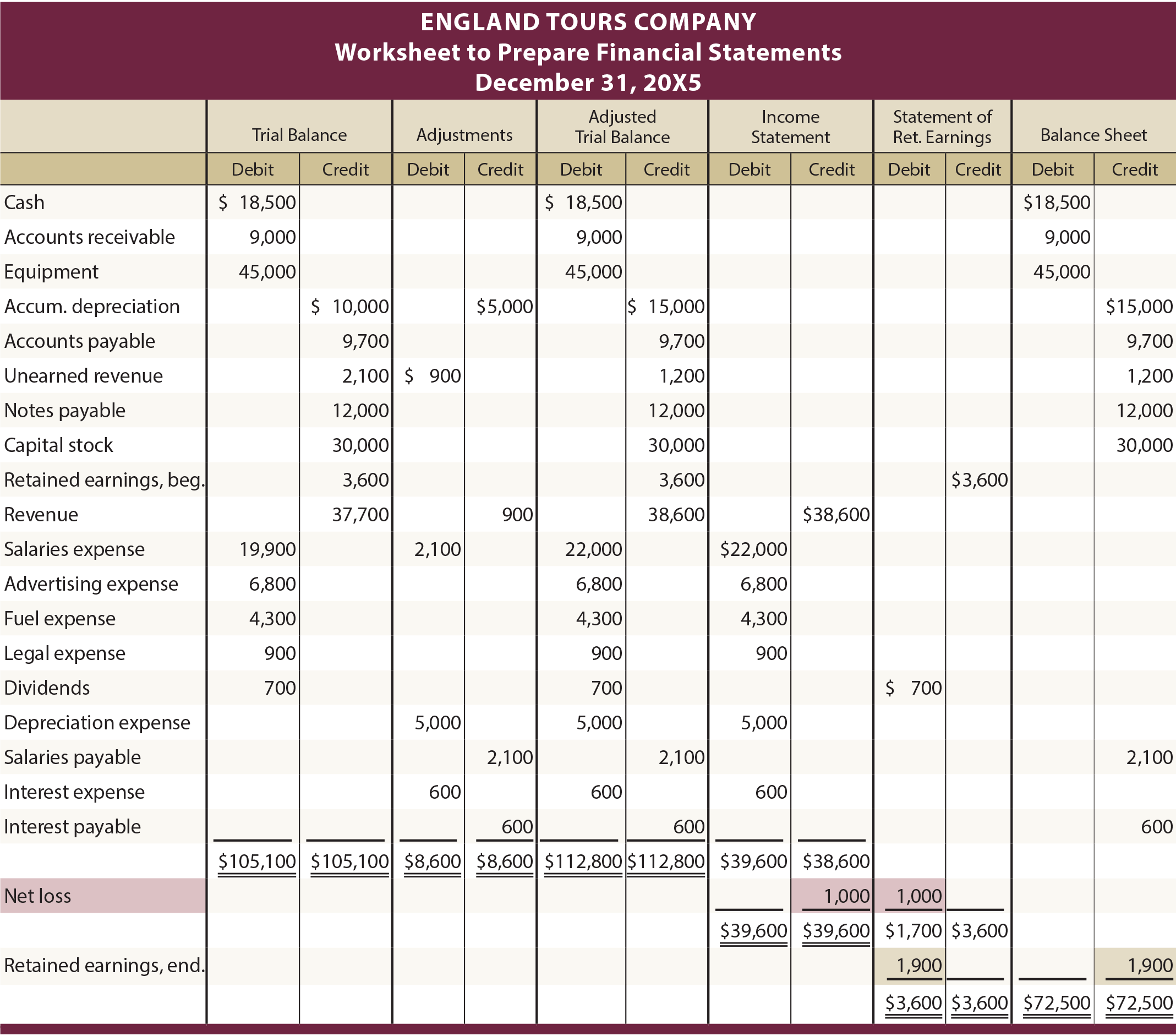

The following illustrates a typical worksheet. The data and adjustments correspond to information previously presented for England. The first set of columns is the unadjusted trial balance. The next set of columns reveal the end-of-period adjustments. The information in the first two sets of columns is combined to generate the adjusted trial balance columns. The last three pairs of columns are the appropriate financial statement extensions of amounts from the adjusted trial balance columns.

For example, Cash is an asset account with a debit balance, and is “appropriately” extended from the adjusted trial balance columns to the debit column of the balance sheet pair of columns. Likewise, Revenue is an income statement account with a credit balance; notice that it is extended to the income statement credit column. This extension of accounts should occur for every item in the adjusted trial balance. Look at the worksheet, and consider the additional comments that follow.

After all adjusted trial balance amounts have been extended to the appropriate financial statement columns, the income statement columns are subtotaled. If credits exceed debits, the company has more revenues than expenses (e.g., $32,800 vs. $30,200 = $2,600 net income)). Or, an excess of debits over credits would represent a net loss. To complete the worksheet, the amount of net income or loss is entered in the lower portion of the income statement columns in a manner which causes total debits to equal total credits. England Tours had a $2,600 net income, and a debit is needed to balance the income statement pair. An offsetting credit is entered in the lower portion of the retained earnings columns. This credit represents income for the year that must be added to retained earnings to complete the preparation of a formal statement of retained earnings. Within the retained earnings columns, the subtotal indicates that ending retained earnings is $1,600 (noted by the excess of credits ($2,600) over debits ($1,000)); this amount is debited in the retained earnings columns and credited in the balance sheet columns, thereby bringing both sets of columns into balance.

The companion website includes a linked animation that presents the development of the worksheet on a step-by-step basis, and may further aid understanding of the worksheet’s construction.

Additional Examples

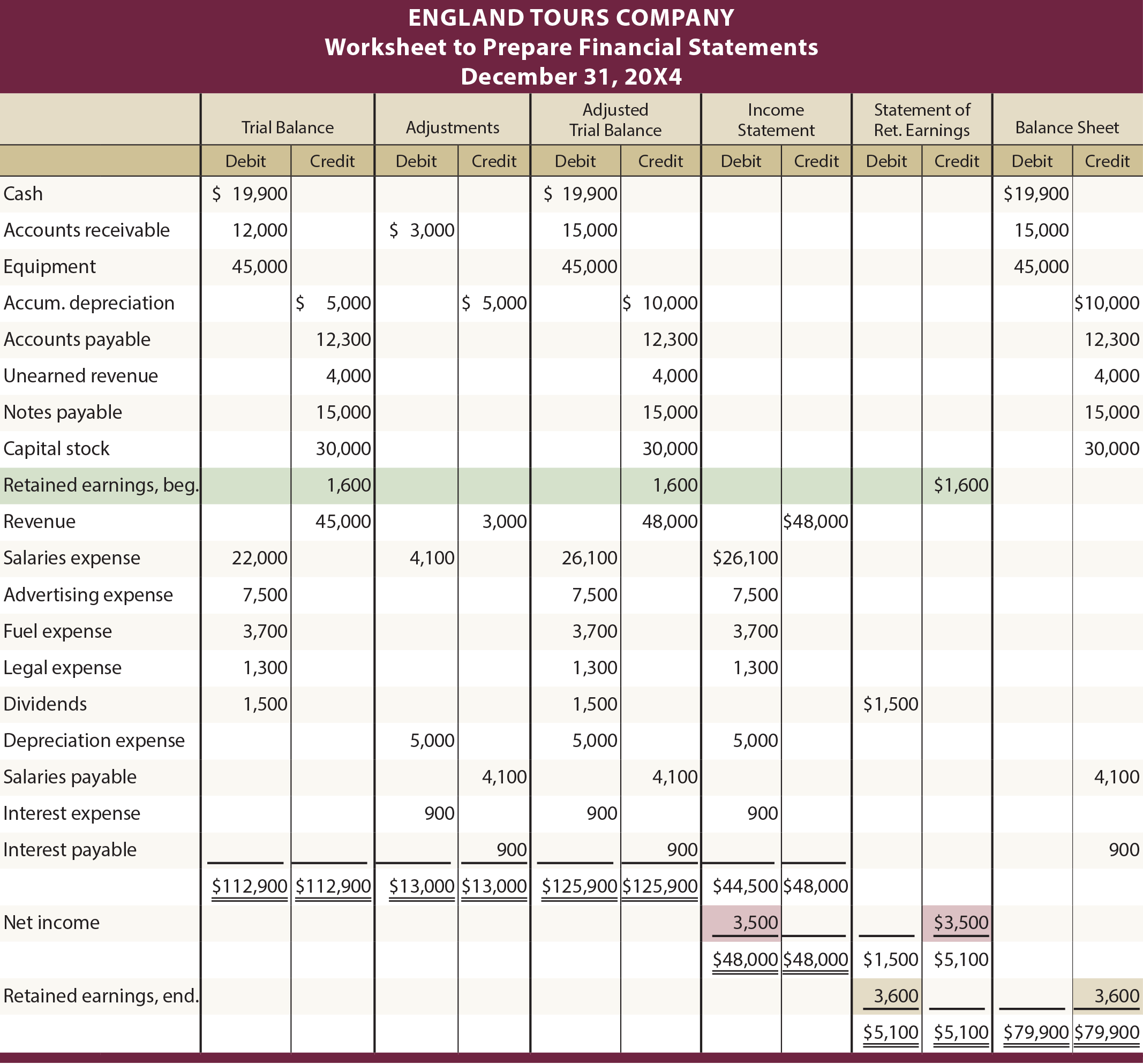

The illustration shown assumed England Tours was formed early in 20X3. As such, there was no beginning retained earnings balance. One may wonder how the worksheet would be influenced by a beginning retained earnings balance. The following is an illustration of England’s 20X4 worksheet, where the $1,600 ending retained earnings from 20X3 carries over to become the beginning balance for 20X4. The other numbers for 20X4 are all assumed.

20X4 Illustration With Beginning Retained Earnings Balance

One may also be curious to see how a net loss situation would be handled in the worksheet. The next illustration is for England’s 20X5 worksheet. It is assumed that England lost $1,000 in 20X5. Notice how the expenses of $39,600 exceed revenues of $38,600 as evident in the income statement columns. The $1,000 balancing amount is reflected as a credit in the income statement and a debit to the retained earnings column.

20X5 Illustration With Net Loss

Need help preparing for an exam?

Check out ExamCram the exam preparation tool!

| Did you learn? |

|---|

| Why might an unadjusted trial balance be inappropriate for preparation of correct financial statements? |

| Who would normally be in a position to suggest adjusting entries? |

| Describe how a trial balance might be updated for adjusting entries? |

| Understand how financial statements are generated from an adjusted trial balance. |

| Have a general awareness of how computer software can be used to facilitate financial statement preparation. |

| When and why might one use a worksheet for preparation of financial statements? |

| Know the appropriate worksheet columns into which amounts from the adjusted trial balance are to be extended. |

| How are profits and losses determined and presented in the worksheet? |