Careful analysis is essential to judge an entity’s financial health. One form of analysis is ratio analysis where certain key metrics are evaluated against one another. The “debt to total assets” ratio shows the percentage of total capitalization that is provided by the creditors of a business:

Debt to Total Assets Ratio = Total Debt / Total Assets

A related ratio is “debt to equity” that compares total debt to total equity:

Debt to Equity Ratio = Total Debt / Total Equity

The debt to asset and debt to equity ratios are carefully monitored by investors, creditors, and analysts. The ratios are often seen as signs of financial strength when “small,” or signs of vulnerability when “large.” Of course, small and large are relative terms. Some industries, like the utilities, are inherently dependent on debt financing but may, nevertheless, be very healthy. On the other hand, some high-tech companies may have little or no debt but be seen as vulnerable due to their intangible assets with potentially fleeting value. In short, one must be careful to correctly interpret a company’s debt-related ratios. One must also be careful to recognize the signals and trends that may be revealed by careful monitoring of these ratios.

Another ratio, the “times interest earned ratio,” demonstrates how many times the income of a company is capable of covering its unavoidable interest obligation.

Times Interest Earned Ratio = Income Before Income Taxes and Interest / Interest Charges

If this number is relatively small, it may signal that the company is on the verge of not generating sufficient operating results to cover its mandatory interest obligation. While ratio analysis is an important part of evaluating a company’s financial health, one should be careful to not place undue reliance on any single evaluative measure.

Contracts

A company may enter into a variety of long-term agreements. For example, a company may agree to buy a certain quantity of supplies from another company, agree to make periodic payments under a lease, or agree to deliver products at fixed prices in the future. There is effectively no limit or boundary on the nature of these commitments and agreements. Oftentimes, such situations do not result in a presently recorded obligation, but may give rise to an obligation in the future.

A company may enter into a variety of long-term agreements. For example, a company may agree to buy a certain quantity of supplies from another company, agree to make periodic payments under a lease, or agree to deliver products at fixed prices in the future. There is effectively no limit or boundary on the nature of these commitments and agreements. Oftentimes, such situations do not result in a presently recorded obligation, but may give rise to an obligation in the future.

This introduces a myriad of accounting issues, and a few generalizations are in order. First, footnote disclosures are generally required for the aggregate amount of committed payments that must be made in the future (with a year-by-year breakdown). Second, changes in the value of such commitments may require loss recognition when a company finds itself locked into a future transaction that will have negative economic effects. These observations should make it clear that an evaluation of a company should not be limited to just the numbers on the balance sheet.

Financing Leases

Chapter 10 introduced the idea of a “financing lease.” Such transactions enable the lessee to acquire needed productive assets, not by outright purchase, but by leasing. The economic substance of financing leases, in sharp contrast to their legal form, is such that the lessee effectively acquires an asset right. Further, the accompanying obligation for lease payments is akin to a note payable. That is, the lessee is under contract to make a stream of payments over time. Accounting rules attempt to track economic substance ahead of legal form. When an asset is acquired under a financing lease, the initial recording is to establish both the asset and related obligation on the lessee’s balance sheet.

Chapter 10 introduced the idea of a “financing lease.” Such transactions enable the lessee to acquire needed productive assets, not by outright purchase, but by leasing. The economic substance of financing leases, in sharp contrast to their legal form, is such that the lessee effectively acquires an asset right. Further, the accompanying obligation for lease payments is akin to a note payable. That is, the lessee is under contract to make a stream of payments over time. Accounting rules attempt to track economic substance ahead of legal form. When an asset is acquired under a financing lease, the initial recording is to establish both the asset and related obligation on the lessee’s balance sheet.

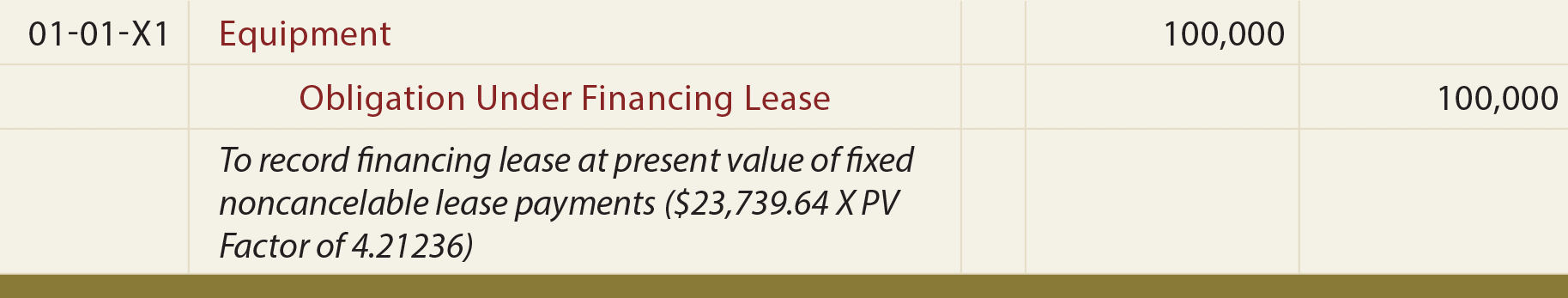

Assume that equipment with a five-year life is leased on January 1, 20X1, and the lease agreement provides for five end-of-year lease payments of $23,739.64 each. At the time the lease was initiated, the lessee’s incremental borrowing rate (the interest rate the lessee would have incurred on similar debt financing) is assumed to be 6%. The accountant would discount the stream of payments using the 6% interest rate and find that the present value of the fixed noncancelable lease payments is $100,000. Therefore, the following entry would be necessary to record the lease:

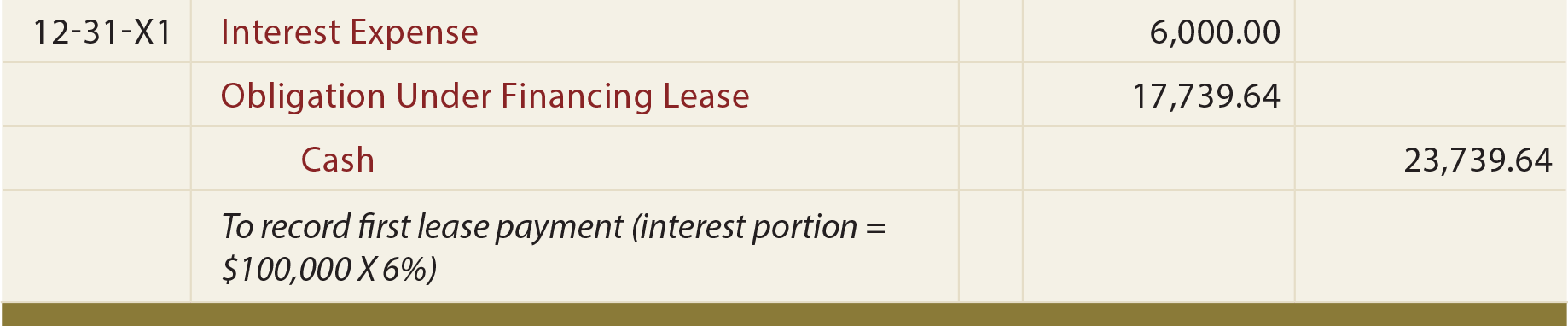

After the initial recording, the accounting for the asset and obligation take separate paths. Essentially, the leased asset is accounted for like any other owned asset of the company. The asset is typically depreciated over the lease term (or useful life, depending on a variety of conditions). The depreciation method might be straight-line or an accelerated approach. The Obligation Under Financing Lease liability is accounted for like a note payable. In the lease example, the amounts correspond to those illustrated for the mortgage note introduced earlier in the chapter. The first lease payment would be accounted for as follows:

Notice that this entry results in recording interest expense, not rent. This strategy would be applied for each successive payment, until the final payment extinguishes the Obligation Under Financing Lease account. The accounting outcome is virtually identical to that associated with the mortgage note illustrated earlier in the chapter.

| Did you learn? |

|---|

| Know how to calculate the debt to total assets and the debt to equity ratios. |

| Know how to calculate the times interest earned ratio. |

| Be able to express an understanding of debt analysis, including cautionary caveats. |

| Differentiate between a liability and a commitment, and understand that significant commitments should be disclosed. |

| Express a basic level of understanding regarding the accounting for leases. |