Receivables arise from a variety of claims against customers and others, and are generally classified as current or noncurrent based on expectations about the amount of time it will take to collect them. The majority of receivables are classified as trade receivables, which arise from the sale of products or services to customers. Such trade receivables are carried in the Accounts Receivable account. Nontrade receivables arise from other transactions like advances to employees and utility company deposits.

Receivables arise from a variety of claims against customers and others, and are generally classified as current or noncurrent based on expectations about the amount of time it will take to collect them. The majority of receivables are classified as trade receivables, which arise from the sale of products or services to customers. Such trade receivables are carried in the Accounts Receivable account. Nontrade receivables arise from other transactions like advances to employees and utility company deposits.

Credit Sales

Purchases of inventory and supplies will often be made on account. Likewise, sales to customers may directly (by the vendor offering credit) or indirectly (through a bank or credit card company) entail the extension of credit. While the availability of credit facilitates many business transactions, it is also costly. Credit providers must conduct investigations of credit worthiness and monitor collection activities. In addition, the creditor must forego alternative uses of money while credit is extended. Occasionally, a borrower may refuse or is unable to pay. Depending on the nature of the credit relationship, some credit costs may be offset by interest charges. And, merchants frequently note that the availability of credit entices customers to make a purchase decision.

Credit Cards

Banks and financial services companies have developed credit cards that are widely accepted by many merchants, and eliminate the necessity of those merchants maintaining separate credit departments. Popular examples include MasterCard, Visa, and American Express. These credit card companies earn money from these cards by charging merchant fees (usually a formula-based percentage of sales) and assess interest and other charges against the users. Nevertheless, merchants tend to welcome their use because collection is virtually assured and very timely (oftentimes same day funding of the transaction is made by the credit card company). In addition, the added transaction cost is offset by a reduction in the internal costs associated with maintaining a credit department.

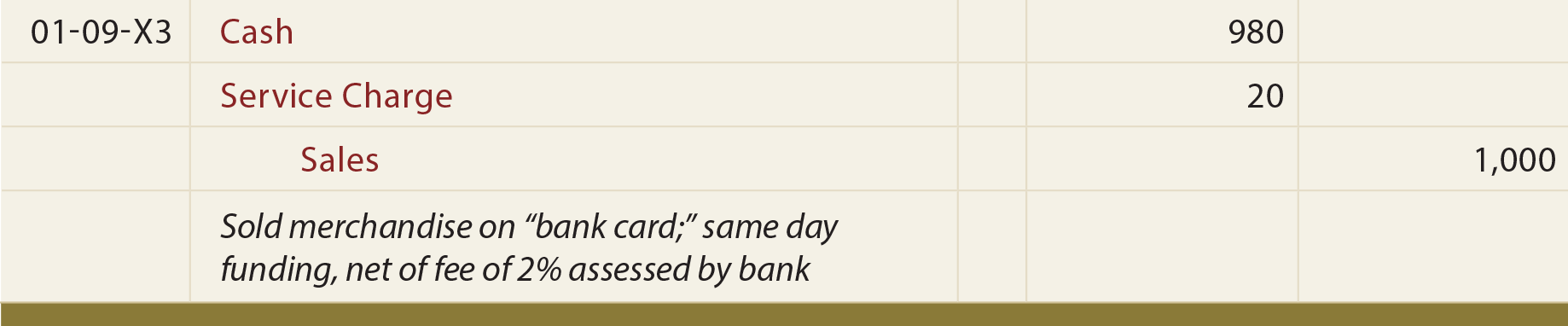

The accounting for credit card sales depends on the nature of the card. Some bank card-based transactions are essentially regarded as cash sales since funding is immediate. Assume that Rayyan Company sold merchandise to a customer for $1,000. The customer paid with a bank card, and the bank charged a 2% fee. Rayyan Company should record the following entry:

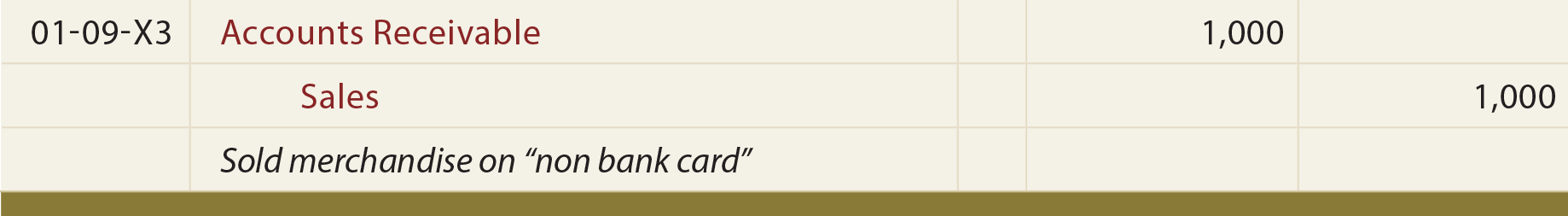

Other card sales may involve delayed collection and are initially recorded as credit sales:

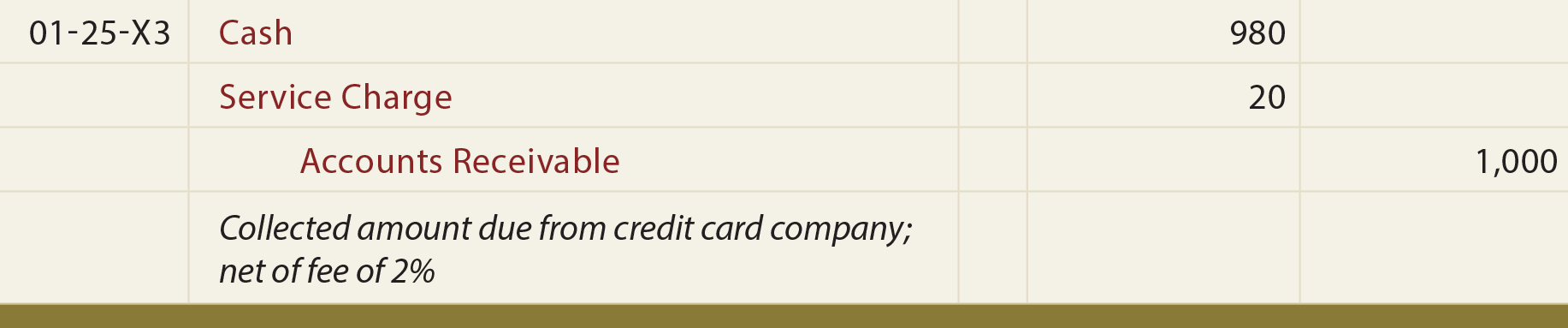

When collection occurs on January 25, notice that the following entry includes a provision for the service charge. The estimated service charge could (or perhaps should) have been recorded at the time of the sale on January 9, but the exact amount might not have been known. Rather than recording an estimate, and adjusting it later, this illustration is based on the simpler approach of not recording the charge until collection occurs.

Need help preparing for an exam?

Check out ExamCram the exam preparation tool!

| Did you learn? |

|---|

| Understand the costs and benefits of credit. |

| Note the distinction between trade and nontrade receivables. |

| Identify the benefits to a firm that arise out of credit card sales. |

| What is the difference (operationally and from an accounting perspective) between bank and nonbank card sales? |