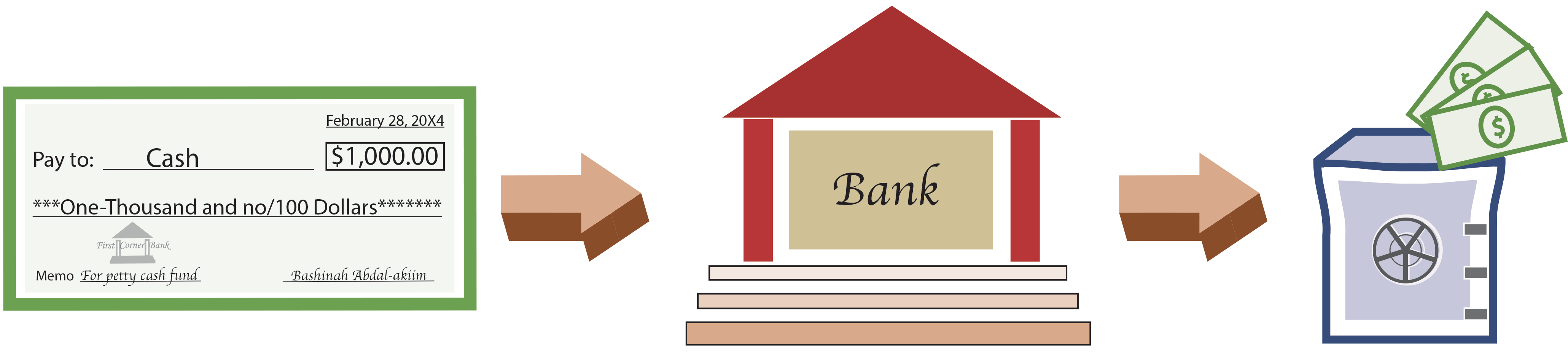

Petty cash, also known as imprest cash, is a fund established for making small payments that are impractical to pay by check. Examples include postage due, reimbursement to employees for small purchases of office supplies, and numerous similar items. The establishment of a petty cash system begins by making out a check to cash, cashing it, and placing the cash in a petty cash box:

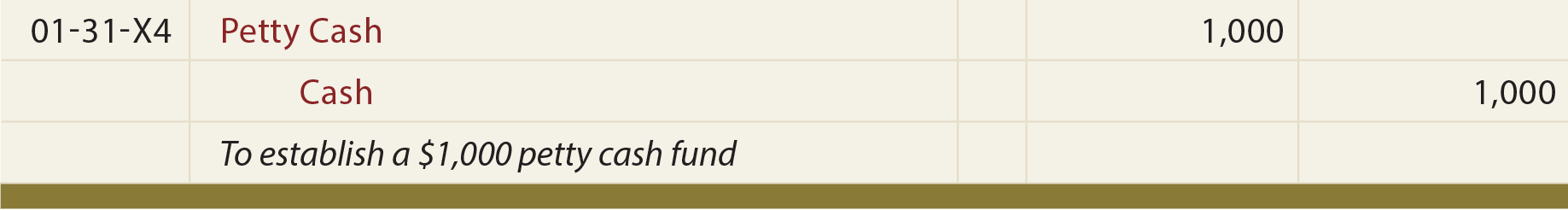

A petty cash custodian should be designated to safeguard and make payments from this fund. At the time the fund is established, the following journal entry is needed. This journal entry, in essence, subdivides the petty cash portion of available funds into a separate account.

Policies should be established regarding appropriate expenditures that can be paid from petty cash. When a disbursement is made from the fund, a receipt should be placed in the petty cash box. The receipt should set forth the amount and nature of expenditure. The receipts are known as petty cash vouchers. At any point in time, the receipts plus the remaining cash should equal the balance of the petty cash fund (i.e., the amount of cash originally placed in the fund).

Replenish Petty Cash

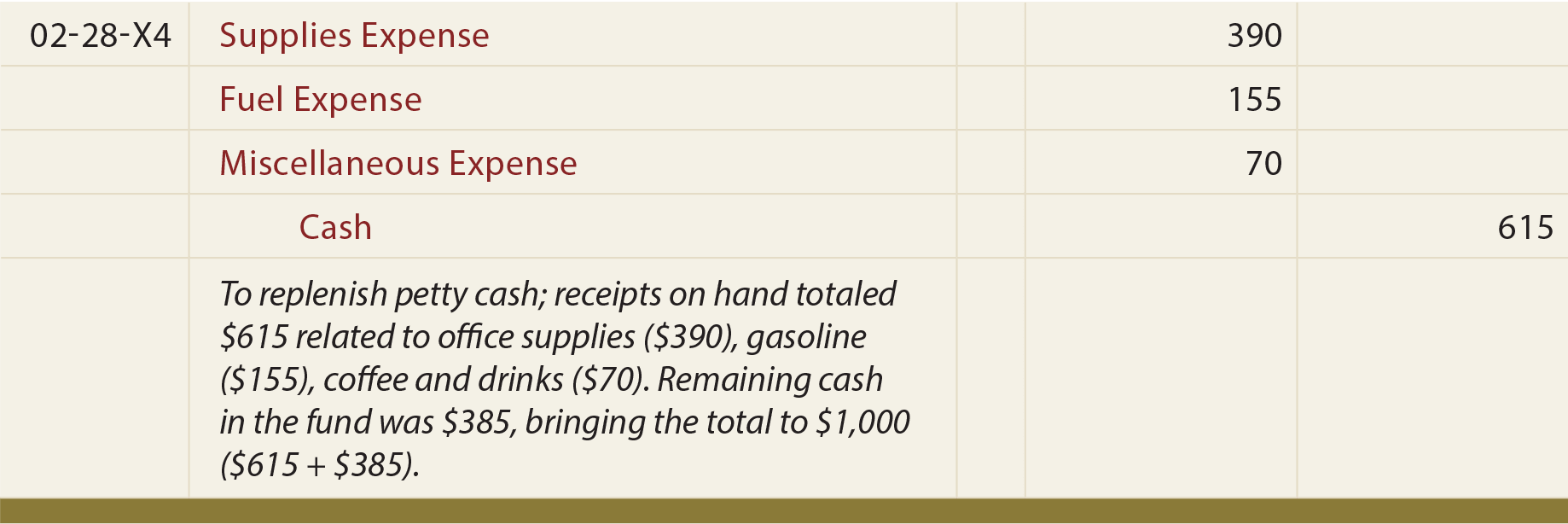

As expenditures occur, cash in the box will be depleted. Eventually the fund will require replenishment. A check for cash is prepared in an amount to bring the fund back up to the original level. The check is cashed and the proceeds are placed in the petty cash box. At the same time, receipts are removed from the petty cash box and formally recorded as expenses.

The journal entry for this action involves debits to appropriate expense accounts as represented by the receipts, and a credit to Cash for the amount of the replenishment. Notice that the Petty Cash account is not impacted — it was originally established as a base amount, and its balance has not been changed by virtue of this activity.

Cash Short and Over

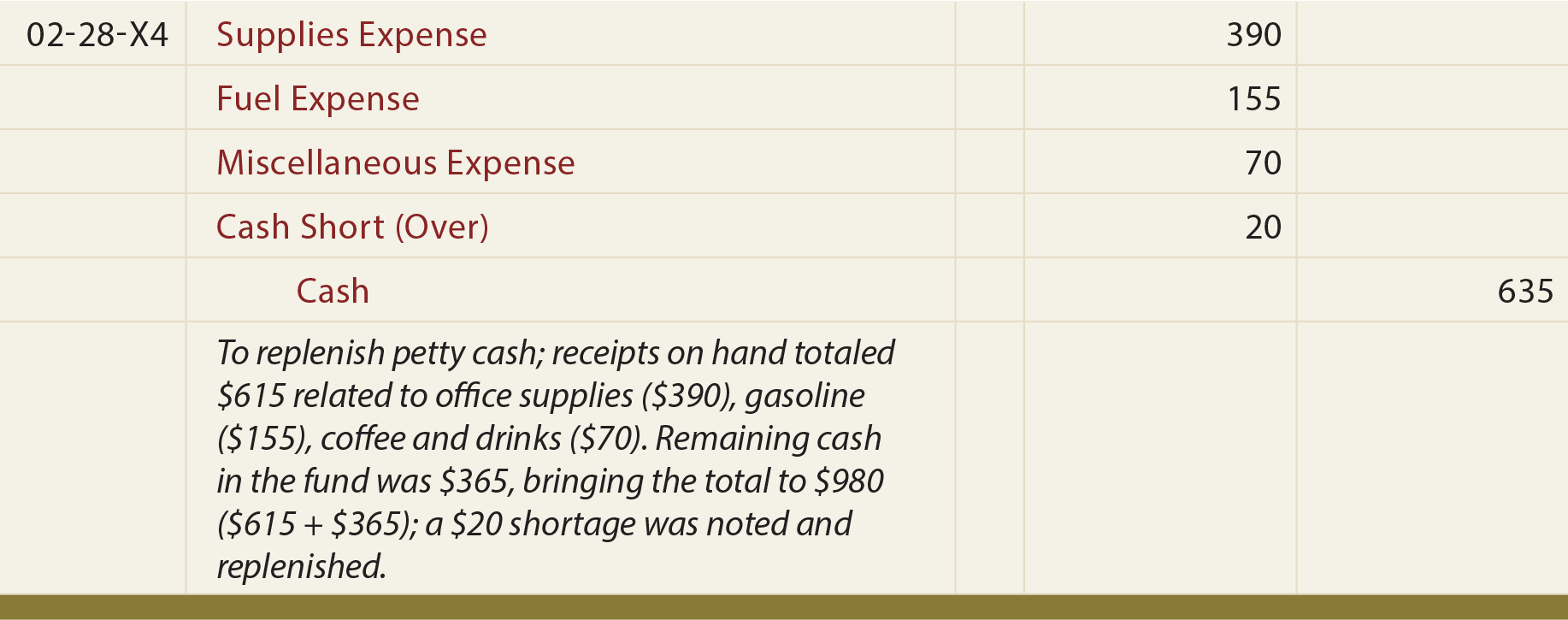

Occasional errors may cause the petty cash fund to be out of balance. The sum of the cash and receipts will differ from the correct Petty Cash balance. This might be the result of simple mistakes, such as math errors in making change, or perhaps someone failed to provide a receipt for an appropriate expenditure. Whatever the cause, the available cash must be brought back to the appropriate level.

The journal entry to record full replenishment may require an additional debit (for shortages) or credit (for overages) to Cash Short (Over). In the following entry, $635 is placed back into the fund, even though receipts amount to only $615. The difference is debited to Cash Short (Over):

The Cash Short (Over) account is an income statement type account. It is also applicable to situations other than petty cash. For example, a retailer will compare daily cash sales to the actual cash found in the cash register drawers. If a surplus or shortage is discovered, the difference will be recorded in Cash Short (Over); a debit balance indicates a shortage (expense), while a credit represents an overage (revenue).

Increasing the Base Fund

As a company grows, it may find a need to increase the base size of its petty cash fund. The entry to increase the fund would be identical to the first entry illustrated; that is, the amount added to the base amount of the fund would be debited to Petty Cash and credited to Cash. Otherwise, take note that the only entry to the Petty Cash account occurred when the fund was established.

Need help preparing for an exam?

Check out ExamCram the exam preparation tool!

| Did you learn? |

|---|

| What is the benefit of a petty cash system? |

| Be able to explain the operation of a petty cash system. |

| Be able to explain the enhancement to internal control that results from a petty cash system. |

| Know how to prepare entries to establish and reimburse a petty cash fund. |

| Understand the importance of measuring cash short and over. |