Oftentimes the production of manufactured products is easily divisible into specific jobs, and the job costing method illustrated in the previous chapter is appropriate. However, the job costing method does not work well when the production cycle involves a continuous flow of raw materials through various processing departments, and the finished output is characterized as homogenous units, each displaying the same basic characteristics. Examples of such “processes” are numerous. Wood pulp is processed into giant rolls of paper, refineries process crude oil into gasoline, iron ore is processed into steel, sand is processed into glass, and so forth. The physical nature of these processes makes it hard to identify and associate specific units of direct labor and direct material with the final output.

Oftentimes the production of manufactured products is easily divisible into specific jobs, and the job costing method illustrated in the previous chapter is appropriate. However, the job costing method does not work well when the production cycle involves a continuous flow of raw materials through various processing departments, and the finished output is characterized as homogenous units, each displaying the same basic characteristics. Examples of such “processes” are numerous. Wood pulp is processed into giant rolls of paper, refineries process crude oil into gasoline, iron ore is processed into steel, sand is processed into glass, and so forth. The physical nature of these processes makes it hard to identify and associate specific units of direct labor and direct material with the final output.

For example, oil is used to produce gasoline. Oil is pumped from the ground, transported, refined, and placed in storage. Throughout the process it is stirred, cracked, and blended so that it is not possible to trace a tank of gasoline back to a specific barrel of oil.

Process Costing

How would one associate the cost of barrels of crude oil with specific gallons of finished gasoline? One would logically try to develop a mathematical approach that would divide the total cost of all oil and allocate it in some proportion to all the gallons of gasoline. This is the essence of process costing. Process costing is methodology used to allocate the total costs of production to homogenous units produced via a continuous process that usually involves multiple steps or departments.

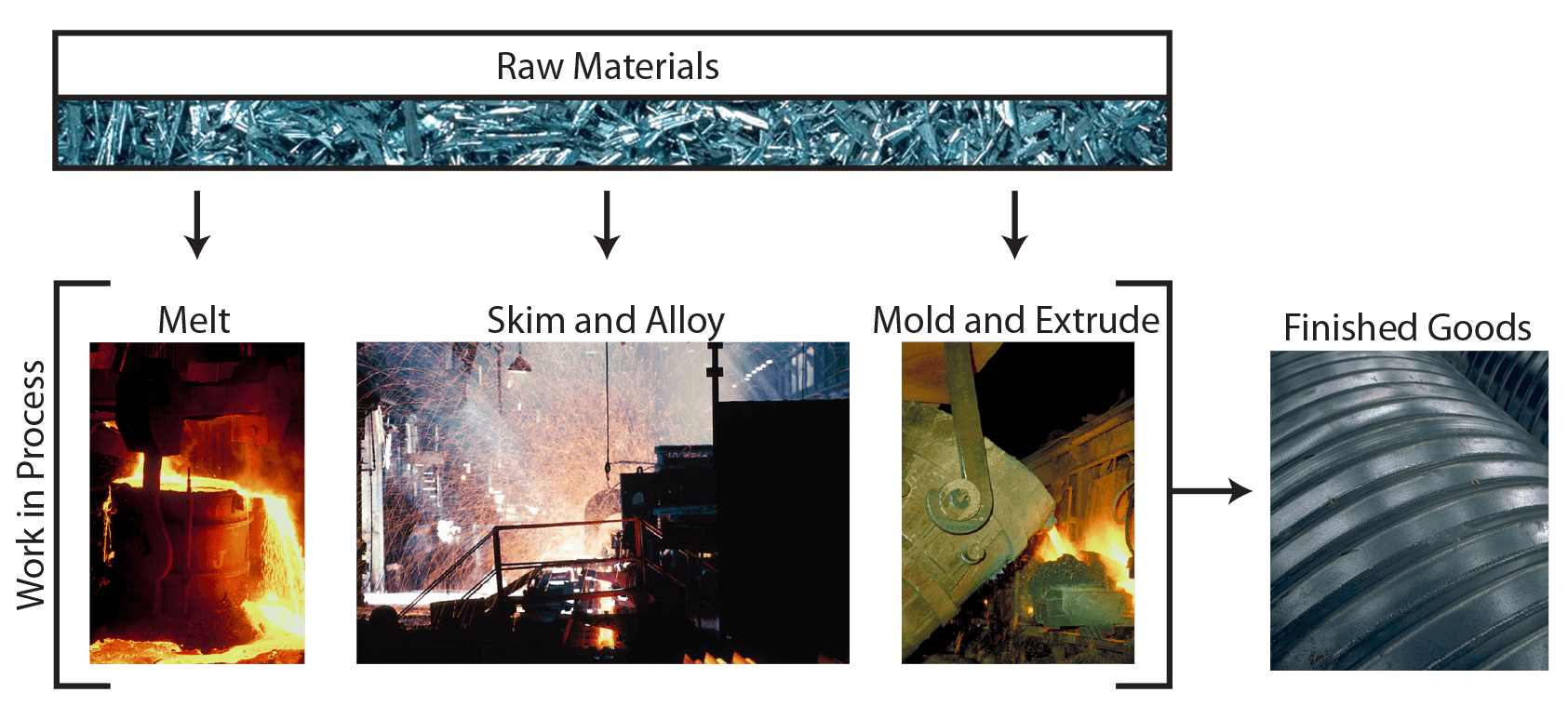

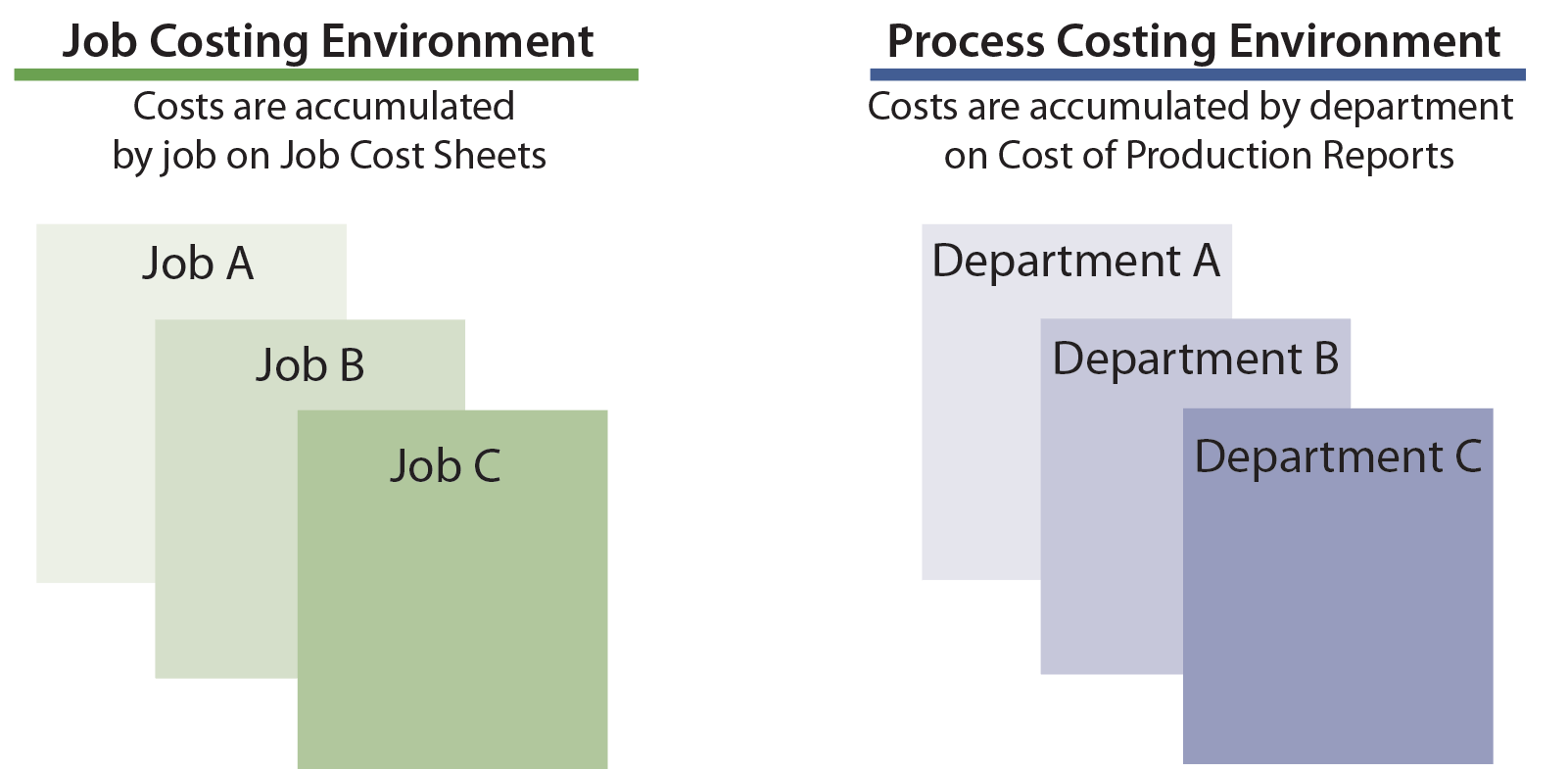

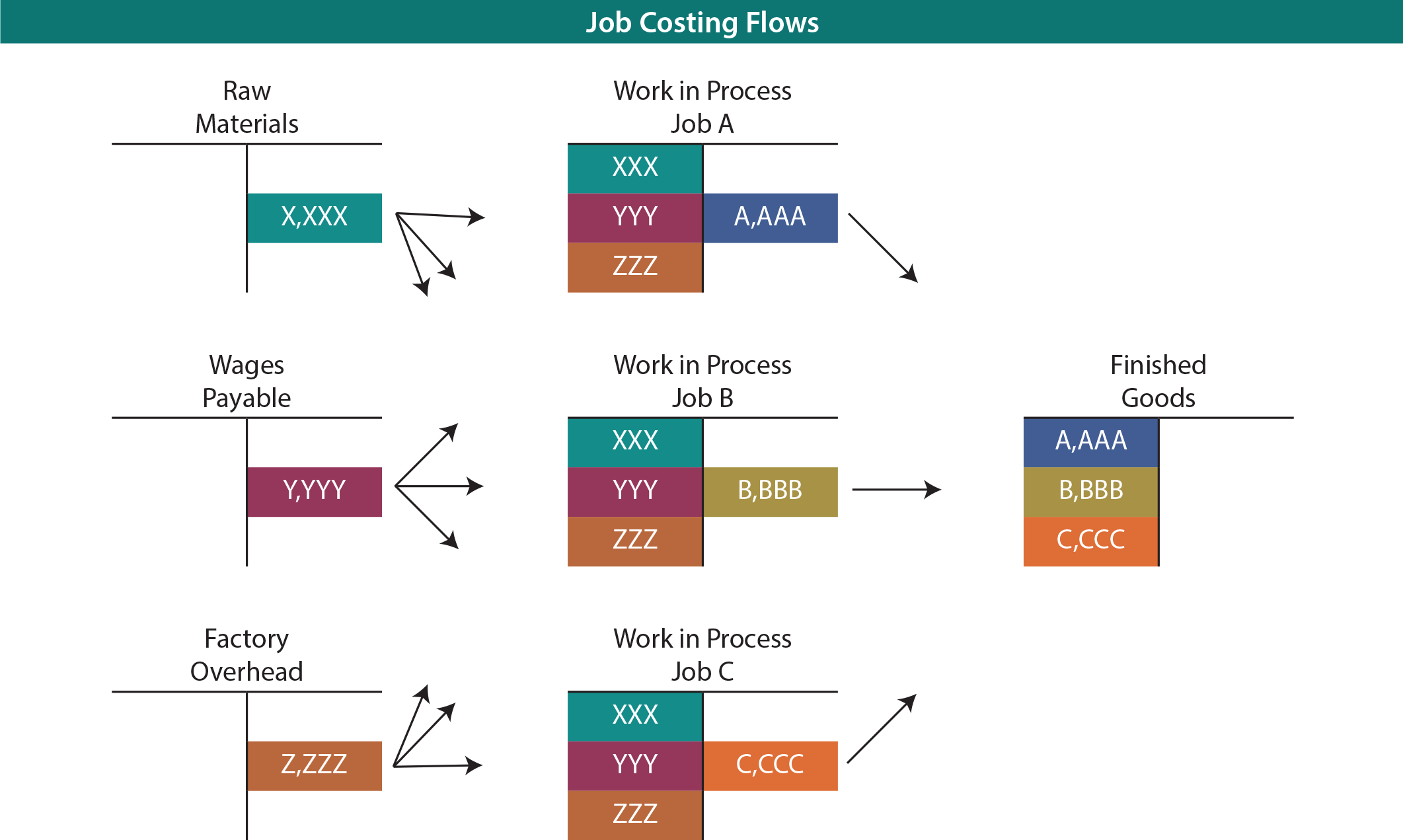

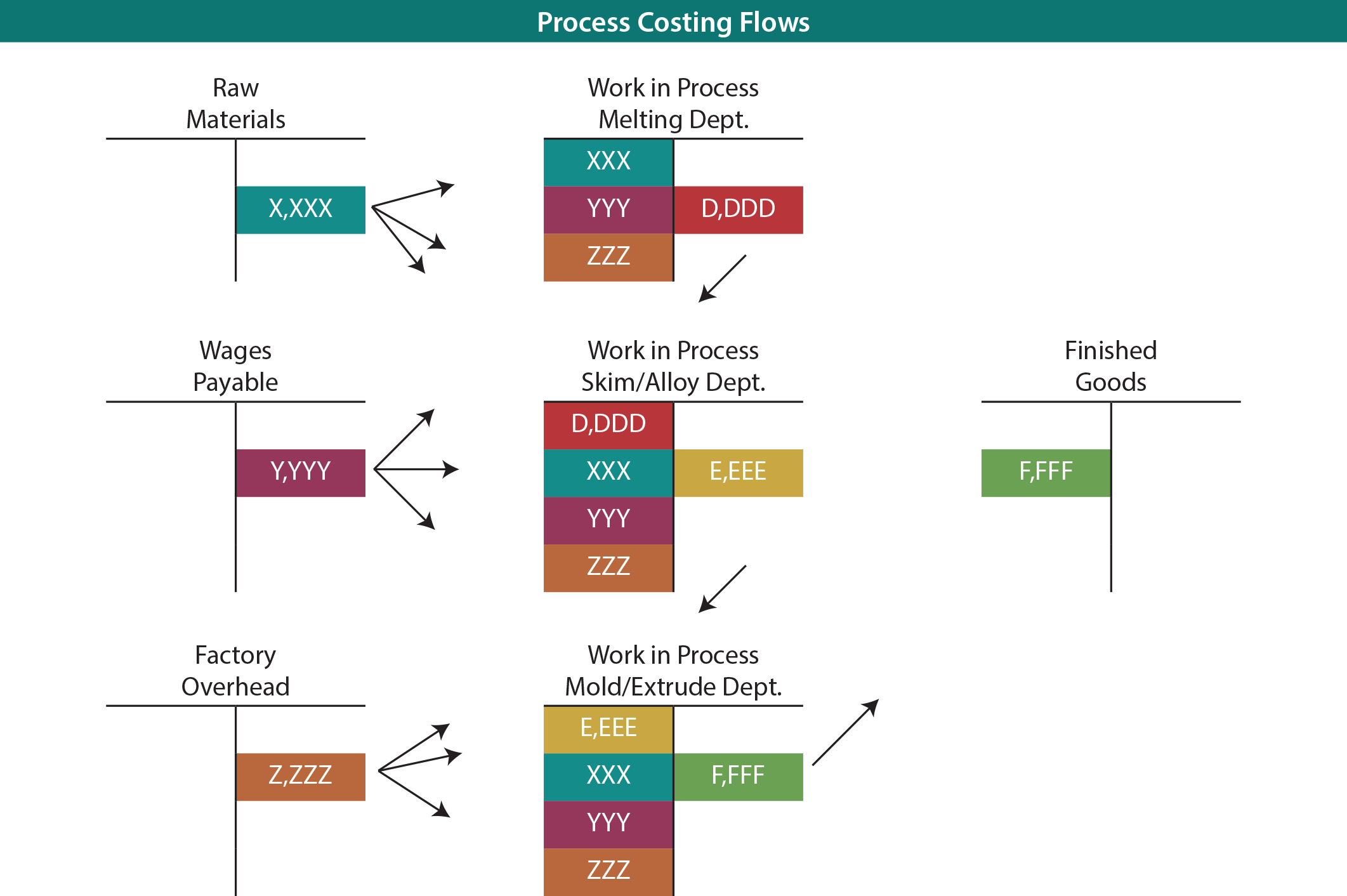

The cost flow concepts from the prior chapter are useful in understanding process costing. The reason is that the same cost flow concepts and accounts will be evident. That is, material, labor, and factory overhead will still occur and still be assigned to work in process. And, amounts assigned to work in process will in turn make their way to finished goods. The debits/credits and financial statement outcomes are very similar. The big difference between job costing and process costing arises in the work in process “units.” Remember, under job costing, costs were captured for each job (recall the discussion about job cost sheets and subsidiary amounts for each job). Under process costing, the costs are captured for each process or department. Think about a steel production factory. The basic processes for producing steel are to (1) melt iron ore (along with perhaps processed coal/coke and limestone), then (2) skim the material while adding alloys to adjust for tensile strength and flexibility, and finally (3) oxygen blast and extrude the material into its finished form (I-Beams, sheet steel, coils, etc.). Below is a representative graphic:

Comparing Job And Process Costing

Note in the above graphic the familiar inventory categories relating to raw materials, work in process, and finished goods. However, rather than observing work in process as being made up of many individual/discrete jobs, see that it instead consists of individual/discrete processes like melting, skimming, and extruding. Material can be introduced into each process. Ore is introduced in the melting stage, alloys in the skimming stage, etc. (this is equally true for labor and overhead). This necessitates the employment of a separate Work in Process account for each major manufacturing activity. Examine the graphic below that compares job and process costing, noting in particular the difference in how costs are shifted out of work in process. Process costing entails handing off accumulated costs from one department to the next.

Cost Of Production Report

With a job costing system, the costs of each job are tabulated on a job cost sheet. A similar tabulation of costs is needed for process costing but with emphasis on costs by department. The cost report that is prepared for each department is termed a cost of production report. The cost of production report provides comprehensive information on the material, labor, and overhead incurred within each department during a period. It is the primary source document for determining how those costs are allocated to actual production. Before looking more closely at the specific content of a cost of production report, it is first necessary to introduce a new concept called “equivalent units.”

| Did you learn? |

|---|

| Describe the approach to accumulating product cost using a job costing system. |

| Describe the fundamental characteristics of a process costing system. |

| Compare and contrast process costing and job order costing systems. |

| Describe the steps in applying process costing. |