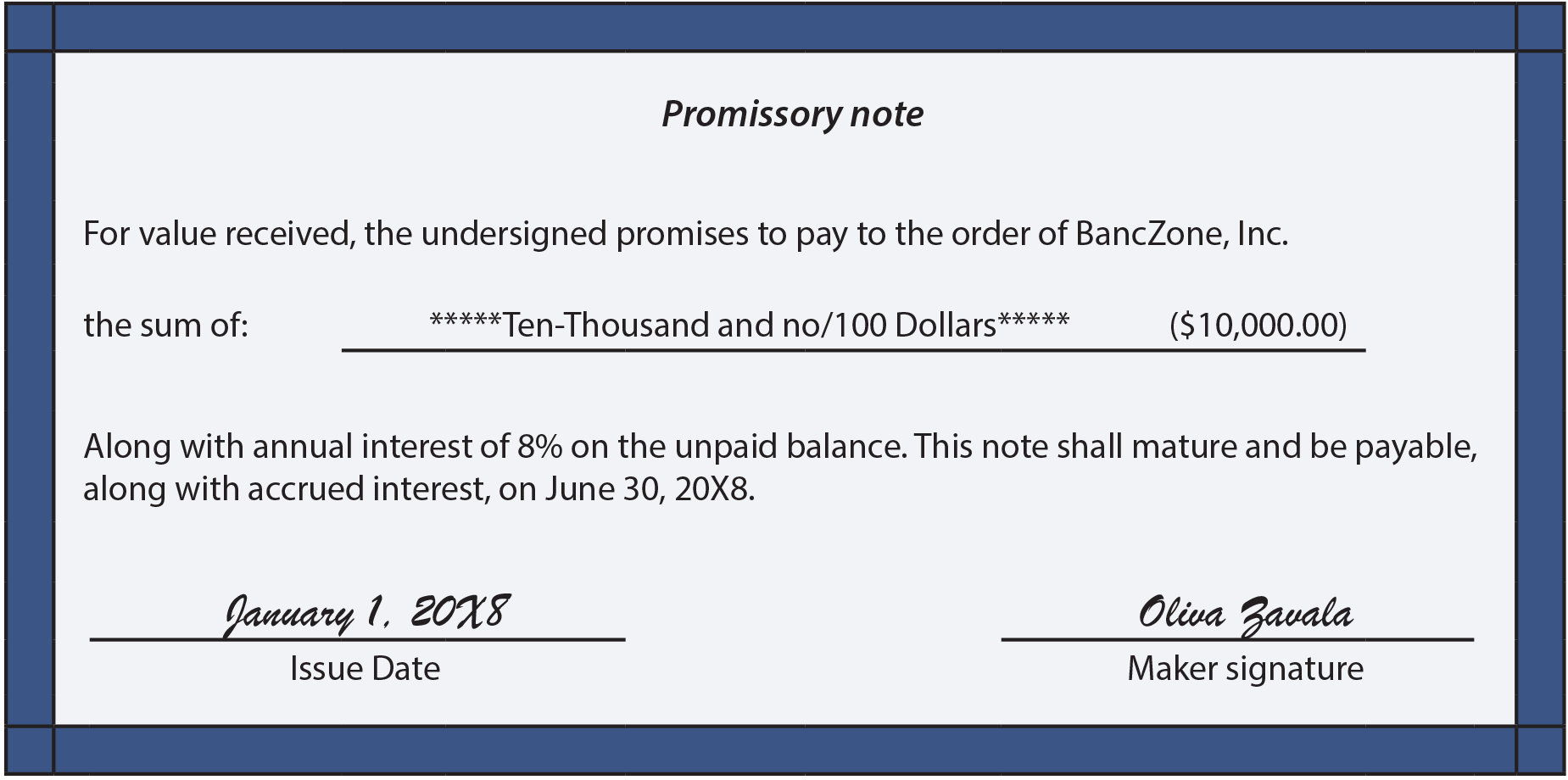

Long-term notes will be considered in the next chapter. For the moment, focus on the appropriate accounting for a short-term note. A common scenario would involve the borrowing of money in exchange for the issuance of a promissory note payable. The note will look something like this:

The preceding illustration should not be used as a model for constructing a legal document; it is merely an abbreviated form to focus on the accounting issues. A correct legal form would typically be far more expansive and cover numerous things like what happens in the event of default, who pays legal fees if there is a dispute, requirements of demand and notice, and so forth. In the preceding note, Oliva has agreed to pay to BancZone $10,000 plus interest of $400 on June 30, 20X8. The interest represents 8% of $10,000 for half of a year (January 1 through June 30).

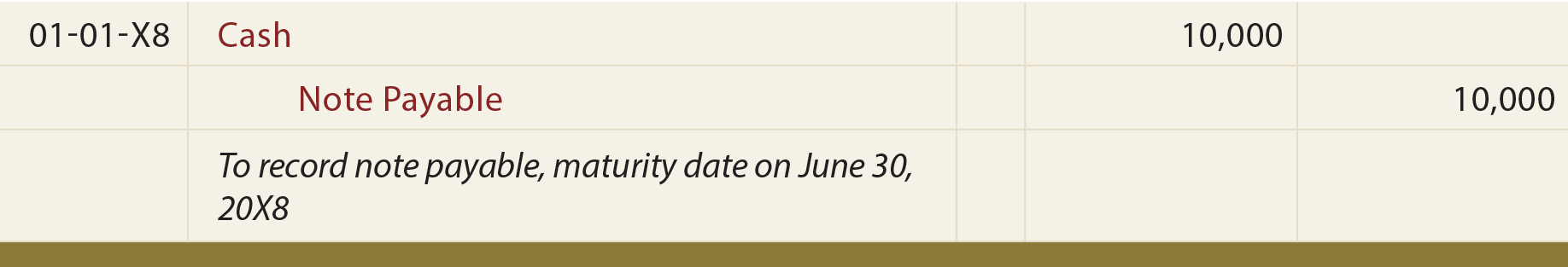

The amount borrowed is recorded by debiting Cash and crediting Notes Payable:

When the note is repaid, the difference between the carrying amount of the note and the cash necessary to repay that note is reported as interest expense. The journal entry follows:

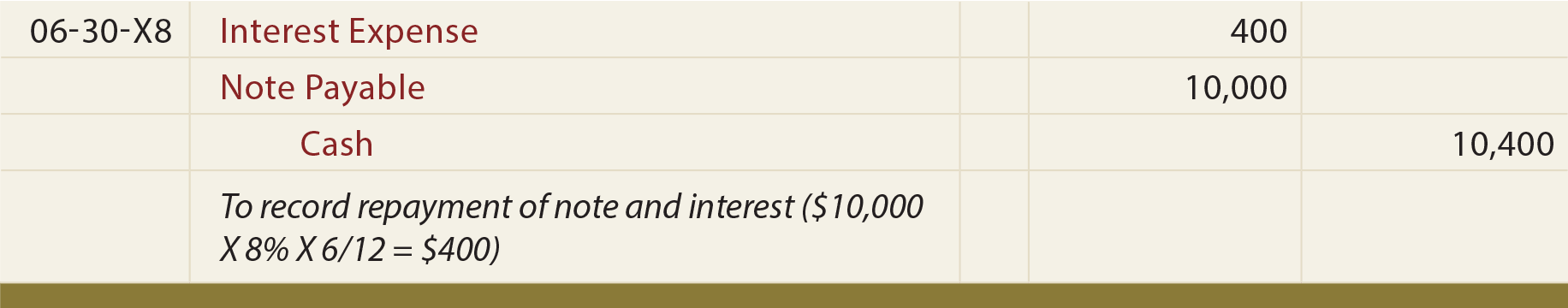

Had the above note been created on October 1, the entries would appear as follows:

In the preceding entries, notice that interest for three months was accrued at December 31, representing accumulated interest that must be paid at maturity on March 31, 20X9. On March 31, another three months of interest was charged to expense. The cash payment included $400 for interest, half relating to the amount previously accrued in 20X8 and half relating to 20X9.

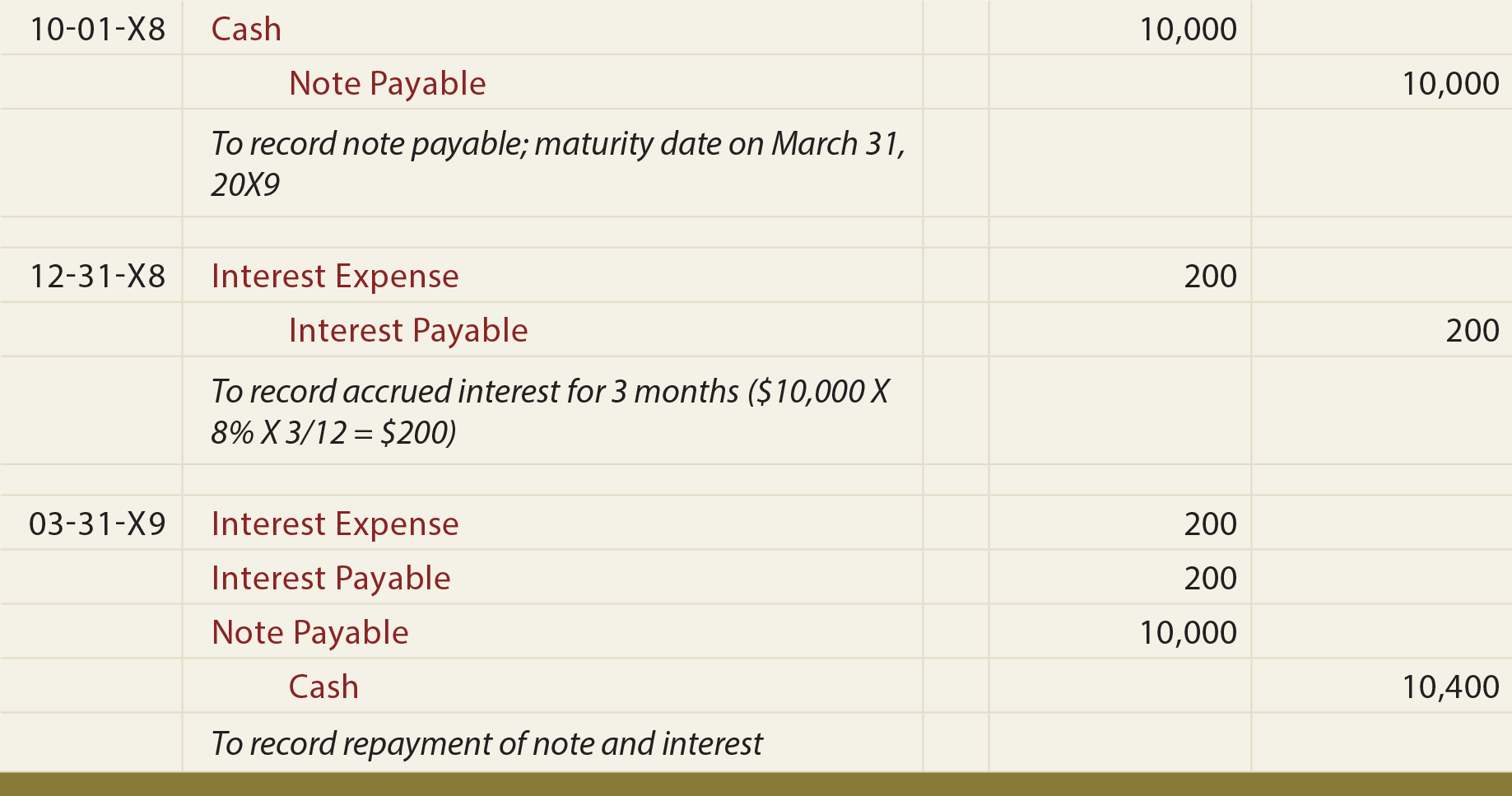

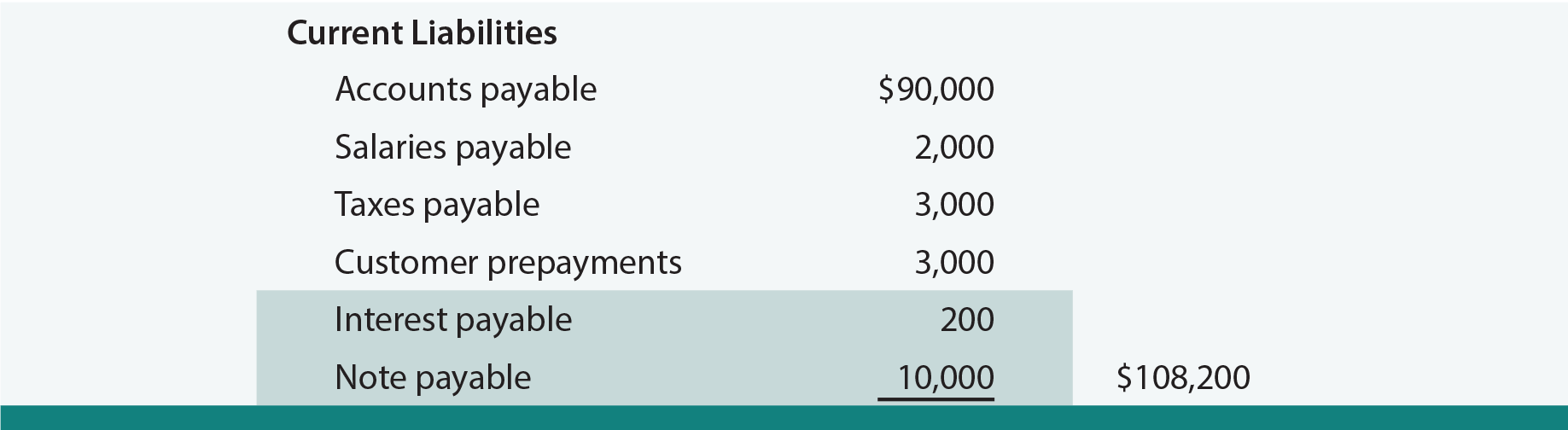

Next, consider how the preceding amounts would appear in the current liability section of the balance sheet at December 31, 20X8. Observe the inclusion of two separate line items for the note and related interest:

In examining this illustration, one might wonder about the order in which specific current obligations are to be listed. One scheme is to list them according to their due dates, from the earliest to the latest. Another acceptable alternative is to list them by maturity value, from the largest to the smallest.

Interest Calculation

Some short-term borrowing agreements may stipulate that a year is assumed to have 360 days, instead of the obvious 365 days. In the old days, before calculators, this could perhaps be justified to ease calculations. In modern days, it may be that a lender is seeking to prey on unsuspecting borrowers. For example, interest on a $100,000, 8% loan for 180 days would be $4,000 assuming a 360-day year ($100,000 X .08 X 180/360), but only $3,945 based on the more correct 365-day year ($100,000 X .08 X 180/365). It becomes apparent that one should be alert to the stated assumptions intrinsic to a loan agreement.

Some short-term borrowing agreements may stipulate that a year is assumed to have 360 days, instead of the obvious 365 days. In the old days, before calculators, this could perhaps be justified to ease calculations. In modern days, it may be that a lender is seeking to prey on unsuspecting borrowers. For example, interest on a $100,000, 8% loan for 180 days would be $4,000 assuming a 360-day year ($100,000 X .08 X 180/360), but only $3,945 based on the more correct 365-day year ($100,000 X .08 X 180/365). It becomes apparent that one should be alert to the stated assumptions intrinsic to a loan agreement.

Next, be aware of the “rule of 78s.” Some loan agreements stipulate that prepayments will be based on this tricky technique. A year has 12 months, and 12 + 11 + 10 + 9 + . . . + 1 = 78; somehow giving rise to the “rule of 78s.” Assume that $100,000 is borrowed for 12 months at 8% interest. The annual interest is $8,000, but, if the interest attribution method is based on the “rule of 78s,” it is assumed that 12/78 of the total interest is attributable to the first month, 11/78 to the next, and so forth. If the borrower desired to prepay the loan after just two months, that borrower would be very disappointed to learn that 23/78 (12 + 11 = 23) of the total interest was due (23/78 X $8,000 = $2,359). If the interest had been based simply on 2 of 12 months, the amount of interest would be only $1,333 (2/12 X $8,000 = $1,333).

Compounding is another concept that should be understood. So far in this text, simple interest has been used in the illustrated calculations. This merely means that Interest = Loan X Interest Rate X Time. But, at some point, it is fair to assume that the accumulated interest will also start to accrue interest. Some people call this “interest on the interest.” In the next chapter, this will be examined in much more detail. For now, just take note that a loan agreement will address this by stating the frequency of compounding, which can occur annually, quarterly, monthly, daily, or continuously (which requires a bit of calculus to compute). The narrower the frequency, the greater the amount of total interest.

One last item to note is that a lender might require interest “up front.” The note may be issued with interest included in the face value. For example, $9,000 may be borrowed, but a $10,000 note is established (interest is not separately stated). At maturity, $10,000 is repaid, representing a $9,000 repayment of borrowed amounts and $1,000 interest. Note that the interest rate may appear to be 10% ($1,000 out of $10,000), but the effective rate is much higher ($1,000 for $9,000 = 11.11%).

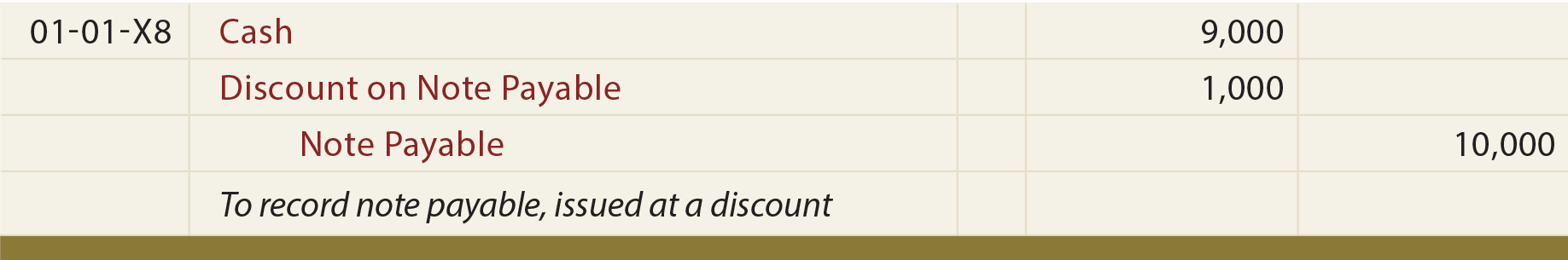

The journal entry to record a note with interest included in face value (also known as a note issued at discount), is as follows:

Observe that the $1,000 difference is initially recorded as a discount on note payable. On a balance sheet, the discount would be reported as contra liability. The $1,000 discount would be offset against the $10,000 note payable, resulting in a $9,000 net liability.

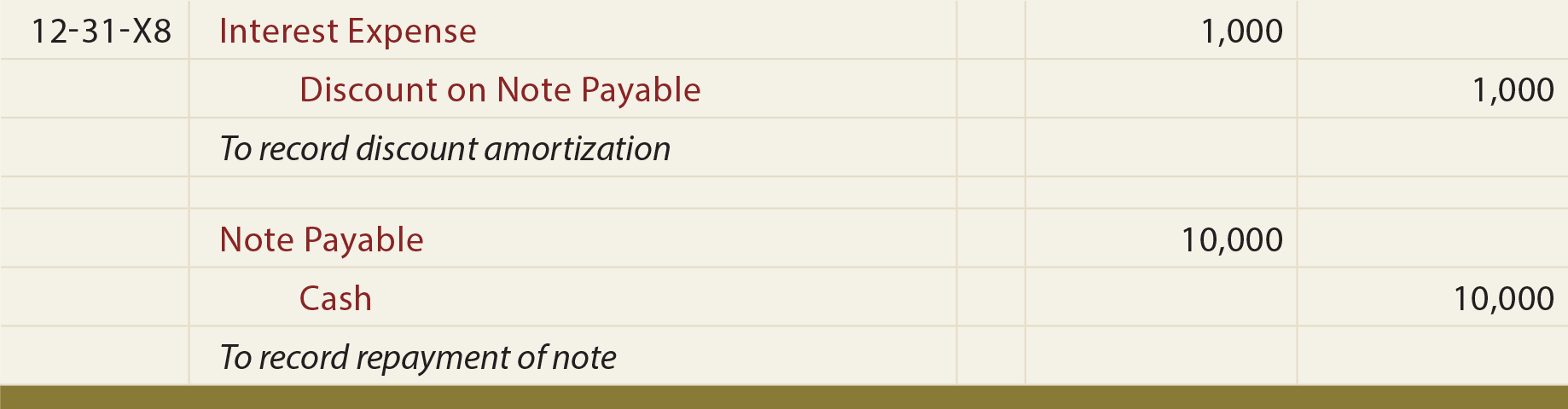

Discount amortization transfers the discount to interest expense over the life of the loan. This means that the $1,000 discount should be recorded as interest expense by debiting Interest Expense and crediting Discount on Note Payable. In this way, the $10,000 paid at maturity (credit to Cash) will be entirely offset with a $10,000 reduction in the Note Payable account (debit).

The entries to record at maturity are as follows:

Be aware that discount amortization occurs not only at the date of repayment, but also at the end of an accounting period. If the preceding example had a maturity date at other than the December 31 year-end, the $1,000 of total interest expense would need to be recorded partially in one period and partially in another.

Truth in Lending

The preceding discussion about unique interest calculations sheds light on the mechanics that lenders can use to tilt the benefit of a lending agreement to their advantage. As a result, statutes have increasingly required fuller disclosure (“truth in lending”) and, in some cases, outright limits on certain practices.

Borrowers should be careful to understand the full economics of any agreement, and lenders should understand the laws that define fair practices. Lenders who overcharge interest or violate laws can find themselves legally losing the right to collect amounts loaned.

| Did you learn? |

|---|

| Understand the nature of notes and the related interest calculations. |

| Know key features of borrowing agreements, and how they can impact the cost of borrowing. |

| Be comfortable with the accounting for notes payable, including notes with interest included in the face value. |

| Know about truth in lending rules. |