Oil and gas reserves, mineral deposits, thermal energy sources, and standing timber are just a few examples of natural resource assets that a firm may own. There are many industry-specific accounting measurements attributable to such assets.

Oil and gas reserves, mineral deposits, thermal energy sources, and standing timber are just a few examples of natural resource assets that a firm may own. There are many industry-specific accounting measurements attributable to such assets.

As a general rule, natural resources are initially entered in the accounting records at their direct cost plus logically related items like legal fees, surveying costs, and exploration and development costs. Once the cost basis is properly established, it must be allocated over the periods benefited through a process known as depletion. Think of it this way: depletion is to a natural resource as depreciation is to property, plant, and equipment.

Depletion

The cost of a natural resource (less expected residual value) is divided by the estimated units in the resource deposit; the resulting amount is depletion per unit. If all of the resources extracted during a period are sold, then depletion expense equals depletion per unit times the number of units extracted and sold. If a portion of the extracted resources are unsold resources, then their cost (i.e., number of inventory units times depletion per unit) should be carried on the balance sheet as inventory.

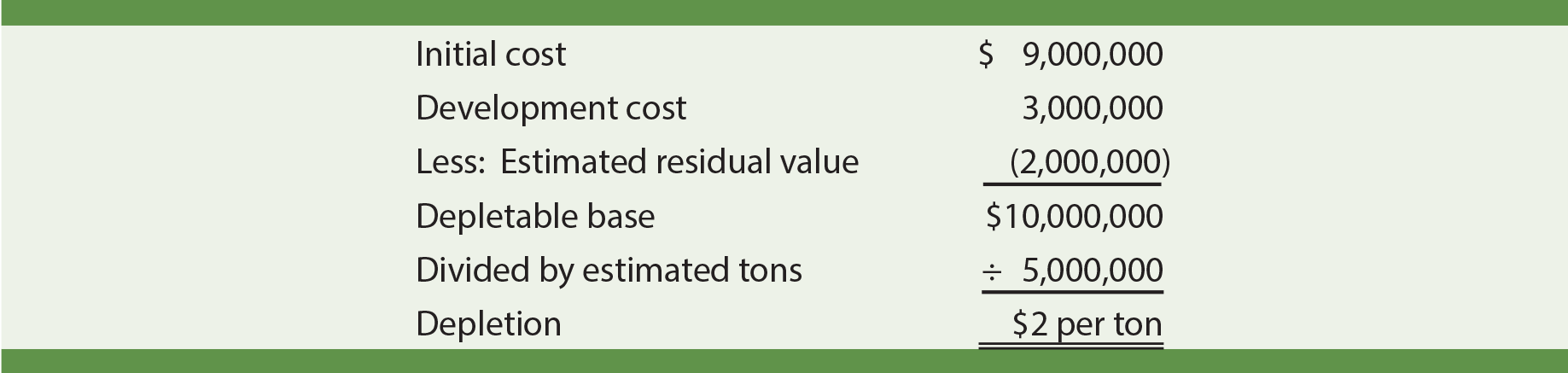

Assume that a mine site is purchased for $9,000,000, and another $3,000,000 is spent on developing the site for production. Assume the site is estimated to contain 5,000,000 tons of the targeted ore. At completion of the operation, the site will be water flooded and sold as a recreational lake site for an estimated $2,000,000. The depletion rate is $2 per ton, as the following calculations show:

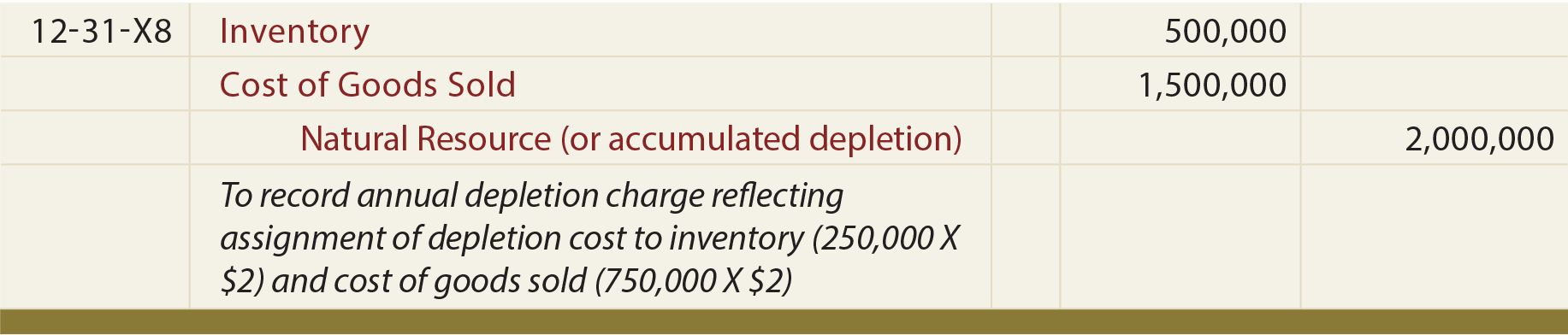

If 1,000,000 tons of ore are extracted in a particular year, the assigned cost would be $2,000,000. But where does that cost go? If 750,000 tons are sold and the other 250,000 tons are simply held in inventory of extracted material, then $1,500,000 would go to cost of goods sold and the other $500,000 would go to the balance sheet as inventory. A representative entry follows:

Equipment Used To Extract Natural Resources

Property, plant, and equipment used to extract natural resources must be depreciated over its useful life. Sometimes the useful life of such PP&E is tied directly to the natural resource life, even though its actual physical life is much longer. For example, if a train track is built into a mine, the track is of no use once the mine closes (even though it could theoretically still carry a train for a much longer period). As a result, the track would be depreciated over the life of the mine. Conversely, the train that runs on the track can be relocated and used elsewhere; as such it would likely be depreciated over the life of the train rather than the life of the mine.

| Did you learn? |

|---|

| What types of assets are considered to be natural resources? |

| Define the term “depletion.” |

| Prepare depletion calculations and the related journal entries. |

| Distinguish between depletion that is charged to expense versus reported as an asset on the balance sheet. |

| Know how to account for depreciable assets used in conjunction with natural resource extraction. |